ETF (Exchange Traded Fund) is an investment fund whose shares (units) trade on an exchange like ordinary stocks, representing a “basket” of various assets (stocks, bonds, commodities), allowing investors to diversify their investments and gain access to a broad market or sector through a single purchase, with the benefits of intraday trading and lower fees.

If you are a beginner investor who wants to understand what an ETF is and how it works, this article is for you. An Exchange-Traded Fund (ETF) is a ready-made portfolio of securities (stocks, bonds, commodities) that trades on an exchange like a single stock. Simply put, by buying one share of an ETF, you immediately acquire tiny shares in all the companies that make up that fund. This makes investing in ETF funds a powerful tool for diversification, risk reduction, and access to global markets even with a small amount of money. The main principle is passive tracking of a selected index, such as the S&P 500 or the FTSE 100, which frees you from the need to pick individual stocks and constantly monitor the market.

What is an ETF and How Does It Work: The “Basket” Principle

To understand the essence of an ETF, imagine a large shopping basket. Instead of buying each fruit individually in different stores, you buy a ready-made basket with a selection. In the world of investing, this “basket” contains not apples and oranges, but shares of hundreds of companies, bonds, or commodities. The management company forms this basket, strictly following the rules of a predetermined index or strategy.

The shares of the ETF itself are then listed on a stock exchange. That’s why it’s called an exchange-traded fund. You, as a private investor, can buy or sell these shares during the trading day through a brokerage account at the current market price. This price (the net asset value per share) changes throughout the day depending on the value of all assets inside the basket and the demand for the fund itself.

The key figure in the ETF’s operation is the authorized participant (AP). These are large financial institutions that ensure the price of an ETF share matches the value of its underlying assets. If the price of the ETF on the exchange starts to deviate from the real value of the assets, APs can create new shares of the fund or redeem existing ones, thereby restoring balance. This arbitrage mechanism is the foundation of ETF efficiency.

From a practical standpoint, the process is extremely simple for you as an investor: you open an account with a licensed broker, fund it, find the desired ETF by its ticker (for example, CSPX for the S&P 500) and buy it like a regular stock. You become a part-owner of a broad market, not a single company.

In summary, the operation of an ETF rests on three pillars: index replication (forming the basket), exchange trading (liquidity and accessibility), and the creation/redemption mechanism (maintaining a fair price). This makes the instrument transparent and predictable.

How Does an Index ETF Differ from Other Exchange-Traded Funds?

The main difference between an ETF and other instruments, such as mutual funds or individual company stocks, lies in its structure and strategy. An ETF is a passive instrument that seeks to replicate the return of a benchmark index. The manager does not make decisions about which stocks to buy or sell; they simply mechanically follow the composition of the index.

Comparing ETFs with Mutual Funds

A mutual fund is often an active fund where the manager tries to “beat” the market by selecting assets they believe are promising. This leads to higher management fees (loads, performance fees), which reduce your final return. A mutual fund unit is bought and sold at a price calculated once a day (at the end of trading). An ETF, on the other hand, trades continuously, like a stock.

Personal experience shows that low costs are critical for a long-term investor. Research by Vanguard, founded by John Bogle, the father of index investing, proves that over a 10-year horizon, the vast majority of actively managed funds underperform their index benchmarks precisely because of high fees. ETFs typically have a management fee (TER) that is several times lower than that of mutual funds.

Comparing ETFs with Individual Stocks

By buying a share of Apple or Tesla, you are betting on the success of a specific company. This can bring huge profits but is also associated with high risk. Problems at one company can collapse the value of your investment. Investing in ETF funds diversifies this risk. Even if one of the hundreds of companies in the basket goes bankrupt, it will have a negligible impact on the overall value of the fund.

As Warren Buffett said in his letter to Berkshire Hathaway shareholders: “Non-professional investors should invest their money in low-cost index funds. This way they will outperform most professional investors.” This quote perfectly reflects the philosophy of passive investing through index ETFs.

Difference from UCITS ETFs and ETNs

In global markets, there are also UCITS ETFs (Undertakings for Collective Investment in Transferable Securities). Essentially, for an investor, they are very similar to ETFs—they also trade on an exchange and passively track an index. Often these terms are used interchangeably, although the legal structure differs. It is more important to look at the underlying asset, the fee, and the accuracy of index tracking (tracking difference). An ETN (Exchange-Traded Note) is a debt security, not a fund that owns assets, which carries issuer risk.

Thus, the key difference of an index ETF is its passivity, low cost, exchange liquidity, and diversification. It is a tool for those who believe in the growth of the market as a whole, not in trying to guess individual winners.

Why is Investing in ETFs Ideal for Beginners?

If you are just starting out, ETFs solve several fundamental problems for a beginner at once: lack of knowledge, small starting capital, fear of loss, and lack of time. Let’s look at the advantages structurally.

1. Diversification “with one click”. An amount equivalent to $100-$200 is enough to buy a share in a portfolio of 500 US or 50 UK companies. It is physically impossible to assemble such a portfolio on your own with that amount.

2. Low entry barrier. The price of one ETF share can range from a few dollars to a few hundred dollars. You are not limited by the need to buy a whole share of an expensive company, for example, Amazon.

3. Simplicity and transparency. You don’t need to analyze companies’ financial statements. You are not choosing a single asset, but an entire market or sector. The fund’s composition and its value are published daily.

4. Low fees. The average management fee (TER) for ETFs on major indices ranges from 0.03% to 0.5% per year. For comparison, the fee for active mutual funds can reach 3-5%. A difference of 2% per year over 20 years, thanks to compound interest, eats up a colossal part of your potential profit.

Comparison of Options for a Beginner Investor

| Instrument | Entry Barrier | Risk Level | Knowledge Required | Main Fees |

|---|---|---|---|---|

| Stock of 1 Company | High (share price) | Very High | High | Brokerage Commission |

| Active Mutual Fund | Low | Medium | Medium | Load, Management Fee (1-5%) |

| Bank Deposit | Low | Low | Low | None (but low return) |

| ETF on a Broad Index | Low | Medium (due to diversification) | Low | Broker Commission + TER (0.03-0.5%) |

It is precisely the combination of these factors that makes ETF funds the starting point for forming your first investment portfolio. You focus not on stock selection, but on more important things: your financial strategy, the size of regular contributions, and psychological resilience.

Practical Guide: How to Start Investing in ETFs from Scratch?

Theory is important, but without practice it is useless. Here is a step-by-step guide based on years of experience advising new investors.

Step 1: Choosing a Broker and Opening an Account

You need a licensed broker that provides access to the exchanges where ETFs are traded. Globally, these are major platforms like Interactive Brokers, Charles Schwab, Fidelity, or eToro. Compare tariffs: commission per trade, account maintenance fees, access to the exchanges you need (NYSE, NASDAQ, LSE). For starters, a tariff with a fixed commission per trade or a percentage of turnover is suitable. Opening a tax-advantaged account like an IRA (in the US) or an ISA (in the UK) will allow you to receive tax benefits.

Step 2: Defining Your Investment Goal and Time Horizon

Ask yourself: “Why am I investing?”. The goal should be specific, measurable, and time-bound. For example, “Accumulate $40,000 for retirement in 20 years” or “Create an emergency fund of $6,000 in 5 years.” Your time horizon determines your risk tolerance. For a period of more than 10 years, you can afford a portfolio with a greater share of equity funds, as the market will have time to recover from potential declines.

Step 3: Selecting Specific ETFs for Your Portfolio

This is the most responsible stage. The main selection criteria:

- Underlying Asset: What’s inside? US stocks (S&P 500, NASDAQ), global stocks (MSCI World), bonds, gold?

- Management Fee (TER/Expense Ratio): The lower the better, especially for funds on the same indices.

- Assets Under Management (AUM): Funds with AUM less than $50-100 million may be less liquid and riskier in terms of closure.

- Index Tracking Accuracy (Tracking Difference): How much the fund’s return has historically deviated from the index’s return. It is better to choose funds with minimal negative deviation.

Step 4: Forming and Contributing to the Portfolio

Don’t invest all your money at once. Use a dollar-cost averaging strategy: divide the amount into 6-12 parts and invest regularly (for example, every month). This allows you to “catch” the average price and reduce the risk of entering at a market peak. Start with a simple structure, for example, 70% in global equities (like CSPX or VT) and 30% in global bonds (like AGG or BNDW). You can complicate it over time.

Step 5: Monitoring and Rebalancing

Your task is not to react to daily fluctuations, but to periodically (once every 6-12 months) check whether the portfolio structure has deviated from the original one due to different asset returns. If stocks have grown strongly and their share has become 80% instead of 70%, sell part and buy bonds, returning to the planned ratio. This disciplines you to lock in profits and buy undervalued assets.

By starting to follow these steps, you move from being a theorist to a practitioner. The main thing is to start, even with a small amount, to make the process a habit.

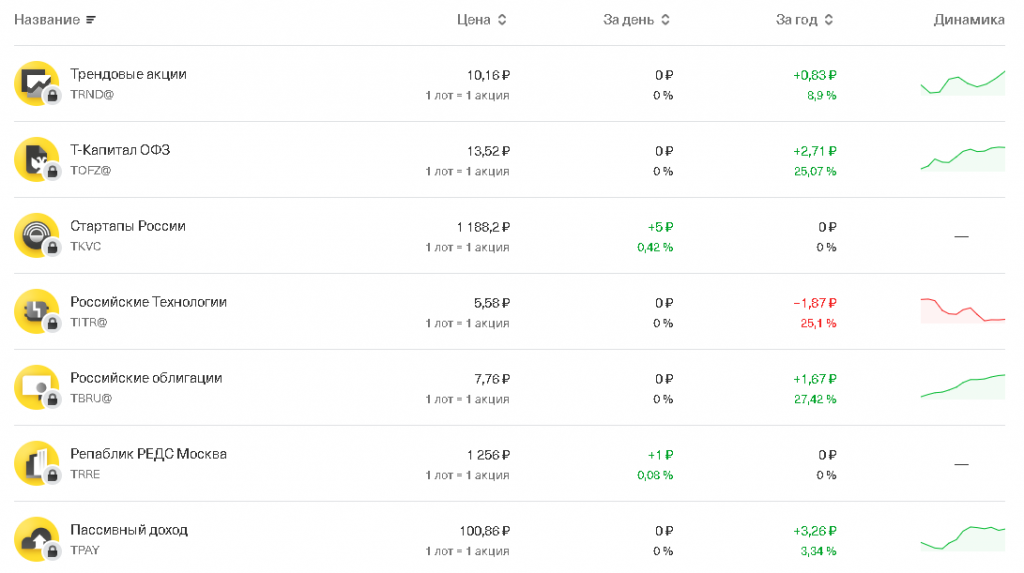

Which ETFs Should a Beginner Choose? Examples of Reliable Funds

Based on the principles of diversification and low cost, beginners should pay attention to broad market indices. Here are a few examples of funds traded on major global exchanges like the NYSE or LSE.

1. Funds on the US Market. The “gold standard” for a beginner is the S&P 500, the index of the 500 largest US companies. On exchanges, it corresponds to:

- SPY (SPDR S&P 500 ETF Trust): Expense ratio ~0.09%. The first and largest S&P 500 ETF.

- VOO (Vanguard S&P 500 ETF): Expense ratio ~0.03%. Known for its ultra-low cost.

These funds provide access to the world’s economic locomotive—technology (Apple, Microsoft), consumer sector, finance.

2. Funds on the Whole World (Global Diversification). To avoid dependence on one country, you can buy the whole world:

- VT (Vanguard Total World Stock ETF): Tracks the FTSE Global All Cap Index. Includes over 9,000 companies from developed and emerging markets. Expense ratio ~0.07%.

- URTH (iShares MSCI World ETF): Tracks the MSCI World Index (developed countries). Expense ratio ~0.24%.

3. Funds on the UK/European Market. For regional diversification:

- VUKE (Vanguard FTSE 100 UCITS ETF): Tracks the FTSE 100 Index. Expense ratio ~0.09%.

- EUNL (iShares Core MSCI Europe UCITS ETF): Tracks the performance of large and mid-cap companies across 15 developed European countries. Expense ratio ~0.12%.

4. Bond Funds to Reduce Volatility.

- AGG (iShares Core U.S. Aggregate Bond ETF): Provides broad exposure to U.S. investment-grade bonds.

- VAGU (Vanguard Global Aggregate Bond UCITS ETF): Offers diversified exposure to global investment-grade bonds. Expense ratio ~0.10%.

Personally, I started my journey with a combination of VOO and AGG, which allowed me to calmly weather the first market corrections, as bonds acted as a buffer. This is a classic conservative “core-satellite” strategy, where the core is broad indices.

Key Risks of Investing in ETF Funds: What is Important to Know?

No financial instrument is without risks. Understanding their nature is part of financial literacy. An ETF is not a magic pill, and its value can fall.

Market Risk (Systemic)

This is the main risk. If the entire market falls (as in 2008 or 2020), the value of your equity ETF will also fall. This is not a disadvantage of ETFs; it is a property of the market. Protection against it is a long-term investment horizon, allowing you to wait for recovery, and diversification across asset classes (adding bonds).

Currency Risk

If you buy an ETF on foreign assets in US dollars (like VOO), and your income is in pounds sterling, then a fall in the pound will bring you additional returns, while a strengthening of the pound will bring losses. Beginners are often advised to hold assets in the currency in which future expenses are planned.

Liquidity Risk and Fund Closure

Little-known ETFs with a small volume of assets (AUM) may have low daily turnover. This means it will be difficult for you to buy or sell a large amount at a fair price without slippage. The risk of fund closure is low for major providers (iShares, Vanguard, State Street), but if it happens, you will receive a cash settlement based on the net asset value.

Tracking Error

An ETF does not perfectly replicate an index due to fees, taxes on dividends, and the replication method (full or optimized). An error of 0.5% per year over 20 years will accumulate a significant amount. Therefore, it is important to choose funds with minimal historical tracking error.

Awareness of these risks should not scare you. It should motivate you to carefully select instruments, diversify, and maintain discipline. Investing is a marathon where the winner is not the one who runs the fastest, but the one who does not leave the race.

Taxation of ETFs for Residents: In Simple Terms

Tax is an inevitable part of an investor’s income. Understanding the basic principles will save you money and nerves.

Basic Rule: The tax on investment income varies by country (e.g., Capital Gains Tax and Dividend Tax in the UK, similar structures in the US). The taxable base is the financial result—the difference between the income from the sale/redemption and the purchase expenses, as well as received coupons and dividends.

Dividends from Foreign ETFs. Many foreign ETFs automatically reinvest dividends (accumulating funds). For tax authorities in some countries, these may be considered capital gains rather than dividend income, which can simplify accounting. If an ETF pays dividends to the account (distributing funds), then the broker, as a tax agent, may withhold tax on them. For foreign funds without a local tax agent, you may have to declare the income and pay tax yourself.

Tax-Advantaged Accounts (ISA, IRA) — a Powerful Optimization Tool. By opening an Individual Savings Account (ISA) in the UK or an Individual Retirement Account (IRA) in the US, you can shelter your investments from capital gains and dividend taxes. This makes such accounts an ideal wrapper for long-term investments in ETFs.

Long-Term Holding Allowances. Many jurisdictions offer favorable tax treatment for long-term holdings (e.g., over one year in the US for lower capital gains rates). For long-term investors, this is a significant benefit.

In summary on taxes: for most beginner investors, the optimal strategy will be to open a tax-advantaged account (like an ISA or IRA), choose large, liquid ETFs, and hold them for the long term. In such a case, record-keeping and tax payments are almost entirely handled by the broker or the account structure itself.

Summary: Where to Start Your ETF Journey Today?

Let’s summarize everything said and formulate a specific action plan for the first weeks. Investing in ETFs for beginners is not a complicated science, but a clear algorithm.

Right now you can take three simple actions that will start the process. First, study the websites of two or three major brokers (like Interactive Brokers, Fidelity, Vanguard) and compare their tariffs for beginners. Second, open a demo account or simply look at the list of available ETFs in the broker’s application, sorted by trading volume. Pay attention to VOO, VT, AGG. Third, determine for yourself the amount you are willing to invest regularly without harming your current budget. Let it be even £50 or $100 per month—it’s important to start and form the habit.

The main mistake of a beginner is the desire for the perfect moment to enter and the search for “that one” fund that will skyrocket. Historical data, for example, research by Credit Suisse, shows that the stock market has always grown in the long-term perspective (20+ years). Your ally is time, not the ability to predict the future. Regular investments through ETFs on broad indices are a bet on the growth of the global economy as a whole, and this is one of the most sensible bets a beginner investor can make.

Your path to financial independence begins not with a large sum, but with the first, conscious step. ETFs are your reliable and understandable vehicle for this journey.