Record Growth Amid Precious Metals Rally

As an experienced investor in precious metals, I am observing a unique situation with palladium. The growing popularity of electric vehicles has created a serious challenge for this metal’s quotations, yet the current dynamics are impressive: spot prices for platinum and palladium have risen this year by approximately 70% and 54% respectively. As of November 25, the price per troy ounce of palladium reached $1390. Such significant strengthening of the major platinum group metals has been made possible primarily due to the powerful support from the historic rise in gold and silver prices.

Features of Palladium’s Price Correlation

Comparison with Other Precious Metals

From my professional experience, palladium demonstrates an almost constant positive price correlation with other precious metals. However, this relationship is traditionally less pronounced than with other assets in this category. It is widely recognized that the closest price correlation is observed between gold and silver.

Platinum’s Market Position

Platinum has a stronger correlation with gold and silver compared to palladium because, unlike the latter, it is actively used in jewelry manufacturing and coin minting.

Industrial Significance of Palladium

Palladium is primarily an industrial metal, whose chemical and physical characteristics are largely similar to platinum. Both metals are widely used in the creation of catalytic converters for internal combustion engines. In this case, palladium is predominantly used in gasoline engines, and platinum in diesel engines.

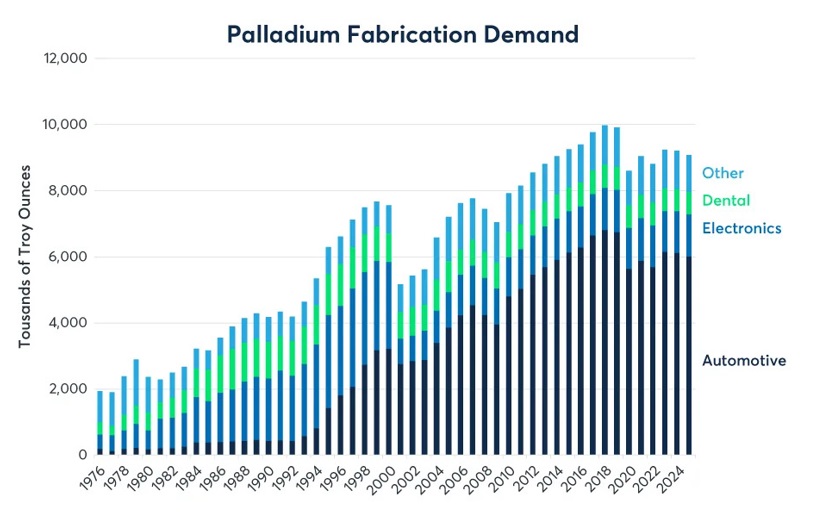

Key Areas of Palladium Use

Automotive Industry

The main consumer of the metal is the auto industry for catalyst production.

Electronics

Use in the production of electronic components.

Dentistry

Application in dental prosthetics and dental alloys.

Jewelry

Limited use in jewelry compared to other precious metals.

Forecasts from Metals Focus for 2025-2026

The consulting company Metals Focus, specializing in precious metals, indicates in its latest report “Precious Metals Investment Focus” that the price of gold will continue to increase in 2026 and potentially reach $5000 per ounce.

The company’s experts justify this by pointing to the persistent uncertainty regarding US trade policy, a weakening dollar, and declining real interest rates as key drivers of future gold price growth.

Furthermore, investment demand for gold will be supported by geopolitical instability and continued purchases of the precious metal by central banks, even if their volumes are below record levels.

Silver, in turn, will benefit from the same factors as gold, including political uncertainty and high investment demand.

Platinum Prospects

As for platinum, the powerful price growth of this precious metal since the beginning of the year is due to the overall strengthening of gold and silver. Market tension related to a metal deficit also contributed to this. Platinum is expected to show its fourth consecutive year of deficit in 2026, however, price dynamics are increasingly dependent on investments and liquidity. Metals Focus forecasts that the average price of platinum next year will be $1670 per ounce, which is 34% higher year-on-year.

Situation with Palladium

Palladium joined the general rally of the precious metals sector, reaching a peak of $1620 per ounce (the increase since the beginning of the year was then about 80%). Metals Focus suggests that the average annual price of palladium will increase by 20%, to $1340 per ounce, against the backdrop of another market deficit, albeit less significant than before. The average price of palladium at the end of November — $1390 per ounce — means the cost has increased by approximately 54% since the beginning of the current year.

Supply and Demand Balance in the Palladium Market

Primary Production

Primary palladium production will decrease by 6% this year, to 6.09 million ounces, due to reduced mining in North America and South Africa. Production in South Africa in the first half of the year was below expectations, which exacerbated the consequences of production restructuring in North America, where output will fall by 26% year-on-year, to 550 thousand ounces. Mining in South Africa will likely amount to 2.12 million ounces, which is 8% lower than the figure a year ago. In Russia, according to expectations, palladium production from MMC Norilsk Nickel will remain virtually unchanged and reach 2.73 million ounces — as stated in the Metals Focus review.

Secondary Supply

Secondary palladium supply will increase by 3% (to 2.68 million ounces), facilitated by the extension of the car trade-in subsidy scheme in China, which implies intensification of catalyst recycling.

Market Deficit

Metals Focus in its latest public review expects that palladium mining in 2025–2026 will remain restrained — the market will remain in deficit, but its scale will decrease. The review focuses not on a sharp increase in mining, but on the growth of secondary supply (recycling), which partially compensates for the decline in mine production.

According to Metals Focus calculations, the palladium market deficit in 2025 will be approximately 367 thousand troy ounces. And in 2026, the deficit will decrease to about 178 thousand troy ounces.

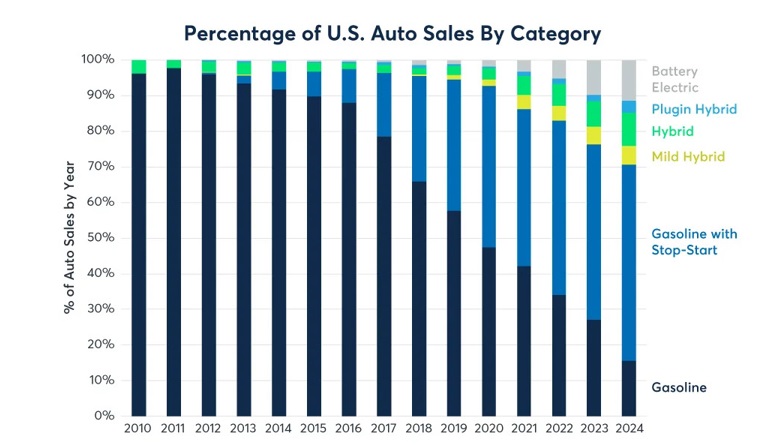

Influence of Electric Vehicles on Demand

Demand for palladium is expected to decrease by a total of 2% this year, to 8.78 million ounces, primarily due to stagnant demand in the automotive industry, as more and more new electric vehicle models appear. The trend in recent years has been an increase in the share of battery electric vehicles (BEV).

For example, in the US in 2024, electric vehicle sales volumes increased to 11.4% of total car sales, while electric vehicle sales in China reached almost 50% of total car sales in the same year.

Dynamics of Palladium Content in Cars

In the graph presented below, it can be observed that the peak of palladium content in an average passenger car occurred in 2021. After this, a certain decrease in palladium use is noted, which is associated with the increasing share of electric vehicles in the market. The growing popularity of electric cars has led to a decrease in demand for palladium, the main application of which remains the production of catalysts for gasoline engines. This explains the drop in palladium prices over the past four years, as investors and market participants expected that the transition to electric vehicles would cause a significant reduction in the need for this metal.

Factors Restraining the Spread of Electric Vehicles

Nevertheless, how strong the influence of these changes on consumer behavior will be is difficult to state at the moment — time will tell. At the same time, it is already known that countries such as China and the United States of America reduced subsidies for the purchase of electric vehicles in 2025, which could slow down the further spread of electric transport. In this regard, a significant decrease in demand for palladium may not occur in the coming years, as sales of gasoline-powered cars still remain significant.

Competition in the Auto-Catalyst Segment

In the November WPIC review 1WPIC is an abbreviation for World Platinum Investment Council. This organization is engaged in researching and promoting the platinum market, as well as analyzing its condition and prospects. , dedicated to platinum (Platinum Quarterly Q3 2025), it is reported that platinum, palladium, and rhodium are metals competing for a share in the same segment (auto-catalysts). It is indicated that platinum partially replaces palladium where it is technologically feasible, especially in gasoline-powered cars against the backdrop of high palladium prices in previous years. The WPIC conclusion 2WPIC publishes reports and studies concerning the global platinum market, for example, on the assessment of the platinum deficit or recovery forecasts for the market. is important, stating that the continuing increase in the share of electric vehicles and hybrids continues to put pressure on the long-term demand for platinum group metals in terms of their use for traditional auto-catalysts.

Price Forecasts for 2026

In October, the Reuters agency 3Reuters is one of the world’s largest news and financial information agencies, founded in 1851. It is owned by the media corporation Thomson Reuters reported that analysts have raised their price forecasts for platinum and palladium for 2026, citing limited mining supply, tariff uncertainty, and rotation of investment demand for gold.

Average forecasts from industry analysts regarding the price dynamics of palladium for 2026, particularly from Reuters and Bloomberg surveys, indicate a moderate increase in the price of palladium relative to current levels. Reuters cites a median forecast of around $1262.50 per ounce, which is higher than the previous forecast of $1100 per ounce and expectations for the average 2025 price of around $1106 per ounce. At the same time, industry experts emphasize the challenges for palladium associated with weak demand, especially in the automotive industry due to the ongoing trend of transition to electric vehicles. Overall, the Reuters forecast coincides with other leading analysts expecting a price range for palladium around $1250-1350 per ounce by the end of 2026. This means that current palladium prices ($1390 per ounce) appear overbought relative to forecasts by approximately 10%.

My Expert Opinion on Palladium Prospects

In my opinion, based on many years of experience working with precious metals, palladium quotations in the coming months will continue to consolidate in the range of $1340-1500 per ounce. I believe that a price decrease to the area of $1200 per ounce is possible in the perspective of 2026 in case of a slowdown in global economic growth rates.

Technical Analysis

On the weekly palladium chart, I observe that in July of this year its prices updated annual highs, exceeding the $1200 per ounce mark. This was followed by a price pullback down by 15%, after which a more powerful growth wave formed, which raised quotations above $1600 per ounce (mid-October). By the end of October, futures had also corrected from the highs by approximately 15% and were near the $1400 per ounce level.

Theoretically, a third concluding wave of price growth for palladium can be expected, however, fundamental factors do not yet favor strengthening. Perhaps after a certain correction in the area of $1340-1500 per ounce, we will witness a new increase in quotations to the area of $1800 per ounce. This may happen if in 2026 gold, silver, and platinum continue to rise in price. The nearest strong support level for palladium is in the area of $1300-1240 per ounce.

📝

- 1WPIC is an abbreviation for World Platinum Investment Council. This organization is engaged in researching and promoting the platinum market, as well as analyzing its condition and prospects.

- 2WPIC publishes reports and studies concerning the global platinum market, for example, on the assessment of the platinum deficit or recovery forecasts for the market.

- 3Reuters is one of the world’s largest news and financial information agencies, founded in 1851. It is owned by the media corporation Thomson Reuters