A moving average (MA) is a trend indicator that calculates the average price of an asset over a specific period of time, such as 10 days or 100 hours. It helps smooth out short-term fluctuations to highlight the main trend and forecast the future direction of price movement.

A moving average helps smooth out short-term fluctuations to highlight the main trend and forecast the future direction of price movement.

In the world of data analysis and financial market trading, there exists a tool that has become a cornerstone for millions of traders and analysts. This method of smoothing time series allows one to see the true direction of the trend behind the noise and chaos of daily fluctuations. We are talking about a powerful and elegant tool that, despite its apparent simplicity, lies at the heart of the most complex trading systems and algorithms. Understanding its mechanisms opens the way to interpreting market behavior and making informed decisions.

Moving Averages: From Mathematical Abstraction to Market Reality

To understand what a moving average means, it is necessary to imagine a continuous stream of data – closing prices, trading volumes, temperature readings, or any other quantities changing over time. The main task here is to isolate a sustainable trend by filtering out random spikes and drops. This statistical method creates a constantly updated average value for a certain period, which literally “slides” along the timeline, providing a smoothed trend line. It is this principle of smoothing a time series using the moving average method that makes the tool invaluable for any type of analysis where dynamics are important, not a static snapshot.

How a Moving Average Works: The Math Behind Smoothing

The mechanism of action of this indicator is based on the sequential calculation of the arithmetic mean. Suppose we consider a series of ten values. The first value of the line will be equal to the arithmetic mean of these ten points. To calculate the next value, the observation window shifts one step forward: the oldest value is discarded, the newest one is added, and the average is recalculated. This process repeats continuously. Thus, what the moving average indicator does is it constantly averages data over the selected interval, creating a lagging but much smoother curve compared to the original “jagged” data. It is important to realize that what the length of the moving average affects directly: a short period makes the line sensitive to price movements, but also to market noise, while a long period provides strong smoothing but causes significant lag behind the current price.

Let’s break down a simple real-life example unrelated to finance. Imagine you measure the air temperature at noon every day. The readings jump: +15, +18, +10, +22, +17 degrees. To understand the general warming or cooling trend, you can calculate the average temperature for the last five days. Today it will be (15+18+10+22+17)/5 = 16.4 degrees. Tomorrow, after receiving a new value, you will discard the oldest one (15) and add the new one, recalculating the average again. The resulting smooth curve will be your personal moving average temperature, which will clearly show whether May warmth is prevailing or April frosts have returned, hiding behind individual sunny or rainy days.

In the context of financial markets, the source data most often consists of trading session closing prices. However, other values can also be used for calculation: the maximum or minimum session price, the average price (High+Low/2), or even a volume-adjusted moving average, where the weight of each price point is proportional to the trading volume, which theoretically should give more significance to periods when the asset was more liquid. Regardless of the choice of source data, the basic mechanics remain unchanged: constant averaging within a moving data window.

Moving Averages: Basics, Types and Calculation Methods

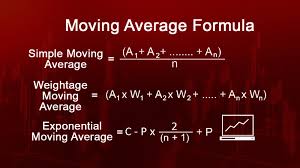

Not all smoothing lines are created equal. The classic, or Simple Moving Average (SMA), is the foundation, but its main drawback is the equal weight of all points in the period. This means that the price from ten days ago affects the current value of the indicator as much as yesterday’s closing price, which from a market logic perspective may not be entirely correct. To solve this problem, more advanced types were developed. The weighted moving average method assigns greater importance to more recent data, reducing the weight as it moves further into the past. Linear weighting is most often used.

The most popular evolution became the Exponential Moving Average (EMA). Its key difference is the application of a smoothing coefficient for the moving average, which is calculated based on the length of the period and assigns an exponentially decreasing weight to all previous values, not just those that fall within the window. Technically, it never completely “forgets” old data, but their influence rapidly diminishes. How to calculate the exponential moving average? The formula is recursive: current EMA value = (Price(current) * K) + (EMA(prev) * (1 – K)), where K = 2 / (N+1), and N is the period. This makes EMA significantly more responsive to recent changes than its simple counterpart with the same period.

The third important type is the Smoothed Moving Average (SMMA), which occupies an intermediate position between SMA and EMA, providing an even smoother line due to the peculiarities of its recalculation formula. Each of these types has its adherents. For long-term trend analysis, the simple one is often preferred, as it reacts less to short-term speculation. For finding entry and exit points within the day, traders tend towards the exponential one due to its speed. Understanding these moving average coefficients and weights is the first step to a conscious choice of tool.

For clarity, the difference can be presented in the form of a table:

| Average Type | Smoothing Character | Reaction to New Data | Typical Application |

|---|---|---|---|

| Simple (SMA) | Strong, uniform | Slow, lagging | Determining long-term trend, support/resistance levels |

| Exponential (EMA) | Moderate, with emphasis on recent data | Fast, responsive | Short-term trading, momentum search, precise entry points |

| Weighted (LWMA) | Depends on weighting method | Very fast (with linear weighting) | Specific tasks requiring clear weight control |

| Smoothed (SMMA) | Very strong, smooth | Very slow | Filtering higher-order market noise, macro-trend analysis |

Where Moving Averages Are Used: From Trading to Meteorology

Although the most striking application of this tool is associated with financial charts, its areas of use are incredibly wide. Any field that requires time series analysis and noise filtering can benefit from it. In economics, they are used to smooth seasonal fluctuations in retail sales or unemployment indicators to identify true cyclical dynamics. In meteorology, they help see the climatic trend behind daily weather anomalies. In engineering and quality management, they are used to track the stability of production processes, identifying deviations.

In machine learning and signal processing, simple moving averaging methods are used as a basic low-pass filter. They suppress high-frequency noise, leaving the low-frequency trend component of the signal. In business analytics, revenue reports are often accompanied by a line showing its growth over the past 12 months, which is nothing more than an annual simple moving average that smooths out quarterly peaks and troughs. This universal principle makes the tool one of the cornerstones of applied analytics.

However, the main arena for applying this indicator undoubtedly remains the financial markets. Here it has transformed from a simple smoothing tool into an entire trading philosophy. Dozens of other, more complex indicators (MACD, Bollinger Bands1Bollinger Bands – a volatility indicator consisting of a moving average and two standard deviations from it, forming a dynamic channel) are built on its basis. Understanding how to use moving averages in trading is a mandatory element of technical education for any market participant, from a beginner to a large fund manager. They are used to identify the trend, determine its strength, find reversal points, and generate trading signals.

Moving Average Analysis: Reading Signals on the Chart

The direct position of the price relative to the indicator line is a primary and powerful signal. If the price chart is consistently above the line, this is a classic sign of an uptrend (bull market). Accordingly, being below indicates a downward movement (bear market). The very fact of the price crossing this smoothing line is often considered a potential signal for a trend reversal. For example, when the price declines and then breaks through the indicator from below upwards (the so-called “golden cross” in a broader sense), it may indicate the beginning of growth. The opposite situation, a breakdown from above downwards (the “death cross“), is interpreted as the beginning of a decline.

Equally important is the analysis of the slope of the line itself. A sharp rise indicates an acceleration of the uptrend, a decline indicates its slowdown or reversal. Horizontal, flat movement after a strong rise or fall often speaks of a consolidation phase2Consolidation (or sideways movement) – a period in the market when the price moves in a narrow horizontal range without a clear trend after a strong move, when the market “catches its breath” before the next surge. Experienced analysts also monitor the distance between the price and the line: a significant gap may signal an overbought or oversold condition of the asset and an imminent correction towards the average.

In my practice of working with charts, one of the most illustrative examples was the behavior of the stock of a large technology company during the boom of 2020. The long-term moving average (200-day) served as an impenetrable support throughout the entire upward phase. Each correction ended with an exact touch or a slight break of this line followed by a powerful bounce. This was a perfect example of the work of the moving average indicator in trading as a dynamic support level in an uptrend. The moment when the price finally consolidated below it on the weekly timeframe became a clear signal of a change in the long-term trend.

How to Trade Using Moving Averages: Practical Strategies

The simplest and most well-known approach is trading on the crossings of two lines with different periods. For example, a strategy may use a combination of a fast line (e.g., with a period of 10) and a slow line (with a period of 50). A buy signal is generated at the moment when the fast line crosses the slow line from below upwards. A sell signal is generated at the reverse crossing from above downwards. This system follows the trend, trying to catch its beginning and hold the position until the reversal. The moving average trading strategy based on crossings is effective in trending markets, but in sideways markets it generates many false signals and leads to a series of losing trades.

A more advanced method is using a moving average channel. It is built by adding two other lines to the central line (e.g., SMA 20), shifted by a certain number of standard deviations or a fixed percentage. This creates a dynamic corridor within which the price moves with a high probability. Bounces from the upper boundary of the channel can serve as signals to sell, and from the lower boundary – to buy. A breakout of the channel boundary, especially confirmed by volume, indicates a strengthening of the trend and the possible beginning of a new strong movement. The gliding on averages strategy tactic often implies exactly working inside such a channel, with stop orders placed outside its boundaries.

How to properly set up moving averages for a specific asset and timeframe? There is no universal answer. The classic period values (50, 100, 200) have become the de facto standard, and many algorithmic systems are guided by them, creating self-fulfilling prophecies. However, adaptation to the asset’s volatility may yield better results. For a calm, liquid asset, longer periods are suitable. For a volatile cryptocurrency, shortened settings are often used so that the indicator keeps up with sharp jumps. The main principle: the settings must correspond to your trading goals. For a long-term investor, the 200-day simple moving average will be more important than the 5-minute exponential one for a scalper3Scalper – a trader who makes many short-term trades (from seconds to minutes) aiming to profit from minimal price movements.

An important rule that beginners often forget: no moving average, no matter how complex, is a magic wand. It always lags. Its value lies in providing a structural, disciplined view of the market, eliminating emotions and obsessions. It does not predict the future but only interprets the recent past, offering a probabilistic assessment of the current moment. Combining its signals with other tools (support/resistance levels, volume indicators, oscillators) sharply increases the effectiveness of a trading system.

The Exponential Moving Average Method: Speed and Sensitivity

Due to its formula, which gives greater weight to the most recent data, the exponential moving average becomes a favorite among active traders. Its key advantage is reduced lag compared to the simple one with an equal period. This allows one to see an emerging trend reversal earlier, albeit at the cost of increasing the number of false signals. How to calculate the exponential moving average manually, we have already considered, but in practice, all calculations are performed by the trading terminal. For a trader, it is more important to understand its logic: this line is more aggressively “attracted” to the last price.

In a rapidly changing market, for example, during the release of important economic news, a simple moving average may turn out to be completely useless, as it will reflect a situation from many days ago. The exponential one, however, quickly adapts to new price levels. This is precisely why intraday traders and scalpers almost always prefer EMA. It is the core of many high-speed strategies where every candlestick is important. Another interesting property is that it can be considered as a filter for an even faster line. For example, the crossing of the price and the EMA can be a primary, sensitive signal, and the crossing of two EMAs with different periods can be a secondary, confirming filter.

Advanced Concepts and Adaptations

In addition to the classic and exponential ones, there are dozens of modifications, each solving specific tasks. The Adaptive Moving Average (AMA), developed by Perry Kaufman, automatically changes its smoothing coefficient depending on current market volatility. In trending periods, it speeds up to follow the movement, and in trendless periods it slows down to filter out as much noise as possible. This is an attempt to create a perfect, self-adjusting tool.

There is also the concept of the inverse function of a moving average. If usually we build a smoothed line based on source data, here the inverse task may be set: from the behavior of the indicator line itself, one can draw conclusions about the nature of the source data that generated it. In a narrower, practical sense, the analysis of price deviations from its average (for example, through the Percent Deviation indicator) is precisely such an inverse function, allowing one to assess the degree of market “overheating“.

The volume-adjusted moving average (VWMA) deserves special attention. In its calculation, each price point (usually the average price of a candlestick) is multiplied by the corresponding trading volume. Thus, days with abnormally high volume, which often indicate actions by large players or important events, have a greater influence on the resulting line. This can help in early detection of true breakouts that are confirmed by volume and sifting out false ones on low volume. For stock analysis, where volume is a critically important confirming factor, this approach can be extremely useful.

As noted by the famous technical analyst John Bollinger, the creator of the eponymous bands:

Indicators don’t give answers, they just organize information so that questions can be asked correctly.

This statement fully applies to our subject. Smoothing lines will not tell you where the price will go tomorrow. But they will help you clearly determine where we are now: in a trend or in a sideways market, at the beginning of a move or at its end, in an overbought zone or in an area of equilibrium.

Smoothing a Time Series Using the Moving Average Method: A Scientific Approach

In statistics and econometrics, the application of this method is strictly formalized. It is used to eliminate seasonal and random fluctuations in order to highlight the main tendency (trend) or cyclical component. The length of the period is selected in accordance with the periodicity of the fluctuations that need to be eliminated. For example, to eliminate seasonality in monthly data caused by the seasons, a period of 12 is often used. This process is an important preparatory step before building forecast models, such as ARIMA4ARIMA (Autoregressive Integrated Moving Average) – a complex model for analyzing and forecasting time series, using, among other things, the concepts of moving averages.

Unlike trading, where settings are often chosen empirically or by tradition, in scientific analysis the choice of window length is justified by data. An iterative method can be used, where the series is smoothed with different periods, and the result is evaluated by criteria of residual variance or visual informativeness. This analysis of the moving average in an academic key ensures objectivity and reproducibility of results, which is critically important for research.

Thus, from the simplest averaging tool to the most complex adaptive algorithms underlying artificial intelligence systems, this method demonstrates an amazing evolution. Its strength lies in its universality, the simplicity of the basic idea, and the endless potential for modifications. Mastering this tool is not just about learning another indicator on a chart. It is about mastering a certain type of thinking aimed at finding order and meaning in the seeming chaos of constantly changing data. It is precisely this ability to separate the signal from the noise, the essence from the secondary, that is valuable not only in financial markets, but also in any field related to decision-making under uncertainty.

Convergence and Divergence of Moving Averages

In the world of trading, there are tools that have proven their effectiveness for decades. One of these keys to understanding the trend is the analysis of the behavior of two price averages. When they converge, it may indicate a slowdown in momentum, while their divergence often signals a strengthening of the current movement. This simple yet powerful principle is the foundation of many popular strategies. By mastering it, you can more accurately determine entry and exit points in the market.

To automate this idea, a special indicator was created — MACD. It visually displays the interaction between the fast and slow lines, removing subjectivity from the chart. Its main component is the histogram, which demonstrates the strength and direction of momentum. Bars above zero usually confirm an upward trend, while bars below zero confirm a downward trend. It is your reliable assistant for confirming signals.

How to correctly apply this analysis in practice? It is worth buying when the short-term line crosses the long-term line from below upwards, indicating the birth of an uptrend. A sell signal arises from the opposite crossover — from top to bottom, foreshadowing a downward reversal. A signal is considered especially strong when the crossover of the lines coincides with the movement of the histogram in the same direction. Always use this method in conjunction with other data to filter out false signals.

Do not expect one hundred percent accuracy from this tool — its strength lies in warning. It works excellently during periods of a pronounced trend, helping you stay in a trade. During periods of sideways market movement, its signals can be misleading, so discipline is important. Start by studying chart history to understand its logic. Gradually, it will become second nature in your analysis of market dynamics.

Make this proven approach a part of your trading system today. It will add clarity to your decisions and help filter out emotions. By combining it with support/resistance levels and volume analysis, you will take your trading to a new level. Open a chart and find an already formed signal to see everything with your own eyes. Start with a demo account and see how these principles work in practice!

The convergence and divergence of moving averages (MACD) is a technical analysis indicator that shows the convergence and divergence of two exponential moving averages (fast and slow), allowing to determine the strength, direction, and potential reversals of a trend, using line crossovers and a histogram for trading signals, but requires use with other indicators due to its lag.

Main elements of MACD:

- MACD Line: The difference between the short-term (e.g., 12-period) and long-term (e.g., 26-period) EMA.

- Signal Line: The EMA of the MACD line itself (usually a 9-period).

- MACD Histogram: The difference between the MACD line and the signal line, reflecting the acceleration/deceleration of momentum.

How to use convergence and divergence:

Line crossover:

- Buy signal: The MACD line crosses the signal line from below upwards (bullish momentum).

- Sell signal: The MACD line crosses the signal line from top to bottom (bearish momentum).

Divergences:

- Bullish divergence: Price makes lower lows, while MACD makes higher lows (potential upward reversal).

- Bearish divergence: Price makes higher highs, while MACD makes lower highs (potential downward reversal).

Limitations:

- Lag: Like all moving averages, MACD is based on past data and reacts slowly to sharp changes.

- False signals: Especially in sideways (flat) markets, it can give frequent false signals (“whiplash” effect).

Best practices:

- Combine with other indicators: Use MACD with RSI to confirm signals and filter out false ones.

- Strong trends: Works more effectively in markets with strong trends.

📝

- 1Bollinger Bands – a volatility indicator consisting of a moving average and two standard deviations from it, forming a dynamic channel

- 2Consolidation (or sideways movement) – a period in the market when the price moves in a narrow horizontal range without a clear trend after a strong move

- 3Scalper – a trader who makes many short-term trades (from seconds to minutes) aiming to profit from minimal price movements

- 4ARIMA (Autoregressive Integrated Moving Average) – a complex model for analyzing and forecasting time series, using, among other things, the concepts of moving averages