Official website: https://mexc.com/

In the dynamic world of digital assets, the choice of a trading platform becomes a strategic decision, determining not only convenience but also the very possibility of implementing complex financial strategies. Among many names, the platform MEXC Global stands out, often mentioned in professional circles for its extensive liquidity and advanced derivative products. This analysis aims to objectively and thoroughly examine all aspects of this exchange service’s operation: from the verification procedure to the intricacies of futures trading and fund withdrawal. We will move away from superficial assessments and delve into technical details, fee structures, and ecosystem features to provide you, as a seasoned market participant, with a complete picture for making an informed decision.

Comprehensive Review of the MEXC Exchange

The platform, known as MEXC Global, was founded in 2018 and has since secured a stable position in the top lines of rankings by trading volume. Its distinguishing feature is an aggressive listing policy: hundreds of altcoins, including many newcomers, find their first liquidity here. This simultaneously gives the platform a reputation as a “hub for new coins” and carries certain risks for inexperienced users. Nevertheless, for a professional trader capable of assessing volatility, such a wide selection is an undeniable advantage. Based on my personal experience, it was precisely on the MEXC exchange website that I often encountered tokens that later showed significant growth while still unknown to the general public.

The platform’s interface may seem cluttered to a beginner, but for an experienced user, it offers the deepest customization. You can configure workspaces, add countless indicators to TradingView charts, and use advanced order types. Liquidity for major pairs with BTC, ETH and USDT is at a very high level, minimizing slippage even in large trades. It is important to note that the MEXC cryptocurrency exchange is actively developing not only the spot but also the margin and futures markets, creating a full-fledged ecosystem for different trading styles.

Security is a cornerstone for any platform, and MEXC implements industry-standard measures: two-factor authentication, cold storage for the majority of funds, an anti-phishing code. However, due to its global orientation and lack of a single regulatory body, users should rely primarily on their own diligence. An analysis of public mexc.com reviews from the community shows a mixed picture: praised for liquidity and operational speed, but sometimes criticized for customer support’s template responses in complex, non-standard situations.

The MEXC ecosystem is not limited to trading alone. The platform offers a wide range of additional services, such as staking, asset lending, participation in Launchpad1Launchpad is a platform (often an exchange or a separate service) that helps new blockchain projects raise capital and investors find promising startups at an early stage, providing them access to token sales before listing (IEO, IDO, ICO), while ensuring project vetting, security, and liquidity. Projects receive funding and an audience, and investors get the opportunity to buy new tokens at a favorable price. for new projects and the M-Day2M-Day (Day M) is an exclusive futures event on the MEXC cryptocurrency exchange, where traders can participate in a competition to earn futures bonuses and open “Wonderland Chests,” receiving rewards and tokens from new projects for achieving a certain trading volume (e.g., 45,000 USDT), which allows increasing potential profit and gaining access to new listings. program, where users can receive free airdrops 3An airdrop is the free distribution of tokens or coins to users as a marketing strategy to promote a new project, attract an audience, and increase awareness, often requiring simple tasks to receive: subscribing to social media, sharing a post, or simply holding another cryptocurrency in a wallet. It is a way for startups to expand their user base and for participants to obtain potentially valuable assets without investment, but caution is required due to the risk of fraud.. These tools allow for comprehensive cryptocurrency portfolio management and passive income generation from idle assets, not just trading. For a strategic investor, such integration of opportunities is a significant advantage, concentrating all necessary actions within one official website.

To summarize this section, MEXC positions itself as a professional tool requiring a certain level of competence from the user. It is not a simplified mobile wallet for buying bitcoin but a complex financial hub, the potential of which unfolds proportionally to the trader’s knowledge.

Registration and Getting Started on the MEXC Platform

The process of registering on MEXC is surprisingly simple and does not take much time, which contrasts with some competitors that require full verification for basic functions. To start trading, it is enough to provide an email address or phone number, create a strong password, and pass a captcha. This opens access to spot trading with a withdrawal limit of up to 5 BTC per day, which is more than enough for most users. I always recommend activating two-factor authentication via Google Authenticator immediately after logging into the account – this is a basic but critically important step for security.

Full verification (KYC) is required to remove withdrawal limits and access some advanced features, such as fiat deposit/withdrawal channels through partners. The process is standard: you need to provide a scan of your passport or other identification document and, in some cases, complete facial verification. The verification time, according to the platform’s statements, is up to several hours, but in practice, based on my observations, it often happens faster. It is important to note that for citizens of a number of countries, access to some services, especially those related to derivatives, may be restricted according to the platform’s internal policy.

After completing registration on the official website of MEXC, an intuitive, albeit information-rich, dashboard opens up to the user. The first step is to review the security settings, where you can configure anti-phishing, manage active sessions, and set up a withdrawal address whitelist. The last feature – the whitelist – is the gold standard of protection against hackers, as it allows withdrawing funds only to pre-confirmed wallets. Neglecting this setting, especially when storing significant amounts, is extremely unwise.

Navigation through the platform is organized via a top menu and several workspaces. For a new user, it may be helpful to start with the “Markets” section to explore available trading pairs. Here you can filter assets by categories, view top lists by volume, and track dynamics. The trading terminal interface can be switched between “Basic” and “Professional” modes, adapting it to your level of preparation. Conveniently, even in professional mode, all basic actions – placing orders, viewing balance – are just a click away.

Thus, the path from the idea of starting trading on the MEXC exchange to making the first trade takes just minutes. The low entry barrier at the start is compensated by the subsequent need for a deep study of the tools for effective and safe work.

Detailed Breakdown of the MEXC Fee Structure

The fee policy is one of the key factors affecting the profitability of active trading. MEXC exchange fees in spot trading are built on the maker-taker4Maker-Taker is a trading fee model on exchanges where a maker creates new liquidity (places a limit order waiting for execution), and a taker consumes it (instantly executes an existing order). Exchanges encourage makers with lower fees (sometimes even with rebates) because they improve the market, while takers pay more for speed and instant execution, taking away liquidity. model and directly depend on the user’s trading volume over the last 30 days and/or the amount of MX tokens (the platform’s native utility coin) in their balance. The base fee level is set at a competitive rate: 0.2% for a taker order and 0.2% for a maker order. This is a standard industry tariff without any discounts.

However, the system provides significant benefits. By holding MX tokens in your balance, you can reduce fees to as low as 0% for maker orders and 0.016% for taker orders at the highest tiers. This makes MX an attractive asset for active traders, turning commission costs into an object for management. It is important to understand that the discount is applied automatically when calculating the fee, and there is no need to manually activate any options.

In addition to trading fees, there are network fees for cryptocurrency withdrawal. These are dynamic and adjusted by the platform depending on the load on blockchain networks. Withdrawing funds on MEXC is always accompanied by a transparent display of this fee before confirming the transaction. In my experience, these charges have often been at or slightly below market average, but before a large withdrawal, it is always worth checking the current fee on the platform itself and comparing it with other services. For popular networks such as BSC (BEP-20) or Polygon, fees are usually minimal.

Fees for margin trading and futures deserve separate attention, which we will discuss in more detail in the corresponding section. It is also worth remembering potential hidden costs, such as the spread when trading exotic pairs with low liquidity. Although the formal fee may be low, a wide spread between the bid and ask price effectively increases the cost of the trade.

For clarity, let’s consider the basic rates for a new user without an MX holding:

| Operation Type | Fee (Base) | Note | |

|---|---|---|---|

| Spot Trading (Taker) | 0.2% | Decreases with trading volume and MX holding | |

| Spot Trading (Maker) | 0.2% | Decreases with trading volume and MX holding | |

| Cryptocurrency Withdrawal | Dynamic | Depends on the network and its load | |

| Cryptocurrency Deposit | 0% | Deposits are always free |

Overall, the MEXC fee model is flexible and beneficial for those who plan to actively use the platform. The ability to reduce costs to almost zero through staking MX is a strong competitive advantage for attracting and retaining professional market makers.

The World of Derivatives: Trading Futures on MEXC

The MEXC futures platform is a separate universe, attracting traders seeking high leverage and a wide selection of contracts. MEXC futures are presented in two main formats: USDT-margined (linear) and Coin-margined (inverse) contracts. The former are denominated in the USDT stablecoin, simplifying profit and loss calculations, while the latter are denominated in the base currency (e.g., BTC), which can be convenient for hedging. Experienced players often use both types depending on their market hypothesis and risk management strategy.

One of the key features is the available leverage, which can reach up to 200x on some contracts.

It is important to emphasize that such leverage is a double-edged sword, capable of both multiplying profits and instantly liquidating a position with a slight market movement against the trader.

The platform offers several margin modes: isolated (where risk is limited to the amount on a separate position account) and cross-margin (where the entire balance on the futures account serves as collateral). For beginners, I strongly recommend starting only with isolated margin and low leverage (no more than 5x-10x) to understand the mechanics and the power of leverage in practice.

Liquidity on the MEXC futures market is high for major pairs like BTC/USDT and ETH/USDT, ensuring fast order execution and minimal slippage. However, when trading exotic altcoin futures, one may encounter wider spreads and less order book depth, requiring extra caution. The platform regularly adds new contracts, following market trends, which allows speculating on the volatility of the newest coins.

The futures terminal interface is even more feature-rich than the spot one. Here you can configure the display of positions, orders, funding accounts (for perpetual contracts), and use complex conditional orders like “Take Profit” and “Stop Loss” in combination (TP/SL). For chart analysis, the full functionality of TradingView is also available. To effectively trade derivatives on MEXC, it is necessary to first study all these tools in demo mode or with minimal amounts.

Thus, the futures segment of MEXC is a powerful professional tool requiring serious preparation and ironclad capital management discipline. It provides access to advanced strategies but proportionally increases risks.

Fees on the Mexc Futures Platform: How Costs Are Calculated

Understanding how MEXC futures fees are formed is critically important for calculating the real profitability of strategies. The structure here also follows the maker-taker model, but the rates and calculation principles differ from spot. Base fees for perpetual contracts (USDT-M) start from 0.02% for the maker and 0.06% for the taker. As with spot, they can be significantly reduced through trading volume and holding the MX token. At the highest levels, rates can drop to 0% for the maker and 0.014% for the taker, creating a huge advantage for high-frequency strategies and market makers.

In addition to the direct commission for opening/closing a position, there is a key cost element for perpetual contracts – the funding fee. This fee is exchanged between long and short positions every 8 hours and is designed to keep the contract price close to the spot market index. The fee size is calculated dynamically and can be either positive (you pay if you hold a position aligned with the majority) or negative (you receive a payment). Before opening a long-term position, it is essential to assess the historical funding rate values for that instrument, as in a strong trend it can consume a significant portion of profits.

To calculate potential costs, here is an example. Suppose you open a taker order for 10,000 USDT with a base fee of 0.06%. At the opening, 6 USDT will be deducted. If you close this position also with a taker order, another 6 USDT will be deducted. Thus, direct commissions will total 12 USDT. To this amount, you need to add (or subtract) all funding fees that accrued during the holding period. This is why scalping strategies, where positions are held for minutes, often avoid the influence of funding but bear high costs on taker commissions.

For Coin-margined futures, commissions are usually slightly lower, and the calculation is done in the base currency. It is always important to check the current fee table in the “Fee Rate” section on the platform itself, as policies may be adjusted. A trader who does not account for all these nuances in their trading model risks encountering a situation where, even with a correct market direction forecast, their trade still ends up unprofitable due to high overhead costs.

Therefore, successful futures trading on MEXC or any other platform is not only the art of price prediction but also a meticulous accounting of all associated costs, from commissions to funding payments.

Practical Guide to Withdrawing Funds from MEXC

The question of “how to withdraw from MEXC?” naturally concerns every user, as the ability to freely withdraw one’s assets is the ultimate criterion for any exchange’s reliability. The withdrawal procedure on the platform is standard but contains several important steps that must be strictly followed. After ensuring that your funds are not tied up in active orders, staking, or as collateral for futures, you can proceed to the withdrawal operation.

The first and most important step is setting up the address whitelist (Whitelist). This is a security feature that, once activated, allows withdrawals only to pre-added and confirmed crypto wallets. Even if a malicious actor gains access to your account, they will not be able to withdraw funds to their own address. Adding an address to the whitelist is usually accompanied by email and 2FA confirmation, as well as a time delay (e.g., 24 hours) before the first use of that address for withdrawal. Neglecting this feature is knowingly taking a huge risk.

For the actual withdrawal, you need to go to the “Assets” -> “Withdraw” section. You select the coin and network (e.g., USDT on the TRC-20, ERC-20, BEP-20 network, etc.).

This is where one of the most common sources of errors and irreversible loss of funds lies.

It is extremely important to ensure that the selected network is supported not only on the MEXC side but also on the receiving wallet or exchange side. Sending USDT via the ERC-20 network to an address intended only for the BEP-20 network will lead to loss of tokens. Carefully check every character of the recipient address.

After entering the address and amount, the system will show the transaction fee and the final amount to be received. Next, you will need to pass a series of checks: email confirmation, entering a code from Google Authenticator, and sometimes SMS. After that, the request is submitted for processing. Withdrawals typically go through three stages: platform processing (which can take from a few minutes to several hours during high-load periods), then the actual transaction on the blockchain. You can track the status in the withdrawal history, and upon completion – verify it using the explorer of the corresponding network by the transaction ID (TxID).

Thus, reliable withdrawal of funds on MEXC is based on three pillars: activating the address whitelist, impeccable verification of the network and recipient address, and using all available means of two-factor authentication. Adhering to these rules makes the process safe and predictable.

Analysis of User Reviews and the Mexc Exchange’s Reputation

When forming an objective opinion about any platform, it is impossible to ignore the voice of the community. Analyzing what MEXC reviews represent in open sources provides valuable information about the service’s strengths and weaknesses. Consolidating opinions from thematic forums, social media, and review sites reveals several consistent trends.

Positive reviews most often concern three aspects: breadth of listings, low fees (after reaching a certain volume or holding MX), and high platform speed. Traders specializing in new altcoins almost unanimously note that MEXC is often the first or one of the first major exchanges where a particular promising token appears. Furthermore, many praise the functionality of the futures platform and the available high leverage. In my own experience, I have also noted the promptness of deposit processing – transactions on the network are typically processed after a minimal number of confirmations.

One experienced trader on a crypto forum noted: “For scalping new pairs with low liquidity at the stage of their first market appearance, MEXC often turns out to be the only place where this is possible with minimal slippage. This is their niche, and they occupy it excellently.”

Criticism, however, also has its clear vectors. The most frequently mentioned problem is the work of customer support. Users complain about long response times during periods of high load (e.g., during sharp market movements) and the template nature of responses that do not always solve complex, non-standard problems. The second most frequent complaint is related to aggressive listing: some projects listed on MEXC turn out to be “scams” or quickly lose value, causing dissatisfaction among inexperienced investors who perceive listing on a major exchange as a sign of quality.

There are also isolated but serious complaints about account freezes due to suspicious activity, with the unfreezing process sometimes being lengthy and bureaucratic. This, however, is common market practice for compliance with regulatory requirements (AML/KYC). To minimize risks, I always advise completing full verification, even if it is not required for basic operations, and clearly documenting the source of funds for large deposits.

Thus, reviews of the MEXC exchange paint a portrait of a powerful but self-service-oriented tool for technically savvy users. It is not a platform for complete beginners expecting “hand-holding” support. Its potential unfolds in the hands of those capable of independently assessing project risks, understanding technical settings, and taking responsibility for their trading decisions.

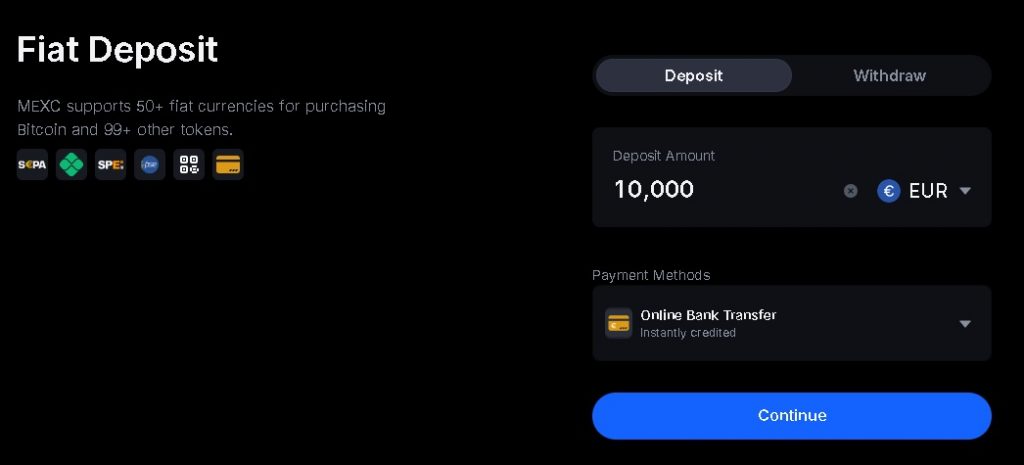

Funding Your Trading Account: Available Methods on MEXC

To start trading, you need to deposit assets into your account. The process of how to transfer money to MEXC mainly boils down to cryptocurrency deposits, as direct fiat top-ups via bank cards or transfers may be unavailable for many regions or go through third-party providers with additional fees. The most common and direct method is depositing cryptocurrency from an external wallet or another exchange.

To fund your account, go to the “Assets” -> “Deposit” section, select the desired coin and blockchain network. The platform will generate a unique deposit address (or memo, if required, e.g., for XRP or XLM). You must send funds from your external wallet precisely to this address. It is extremely important, as with withdrawals, to ensure network compatibility. If you select the BEP-20 network for a USDT deposit, you must send the coins via the Binance Smart Chain network, not Ethereum ERC-20. Deposits are always free; only the blockchain network charges a fee on the sender’s side.

For users without cryptocurrency, there is an option to purchase through third-party partners like Simplex, Mercuryo, or Banxa. In this interface, you can select a fiat currency (euros, dollars, etc.) and pay with a bank card. This method is significantly easier for beginners, but one should be prepared for higher fees (3-5% or more) and limits set by the providers, not the exchange itself. Geographical restrictions may also apply.

After sending the transaction, its status can be tracked. Funds usually require a certain number of network confirmations to be considered final. For Bitcoin, this might be 2 confirmations; for Ethereum – 30-40; for faster networks like Tron – even fewer. Once confirmations are received, the assets appear in your spot wallet on MEXC. If a deposit is delayed, the first step is to check the transaction status in a blockchain explorer (e.g., Etherscan for ETH) using its hash (TxID).

Thus, the answer to the question “how to fund a wallet on MEXC” lies in choosing between a direct crypto deposit (cheaper but requires having crypto assets) and purchasing via fiat gateways (simpler but more expensive). For active traders, the first option is the primary one.

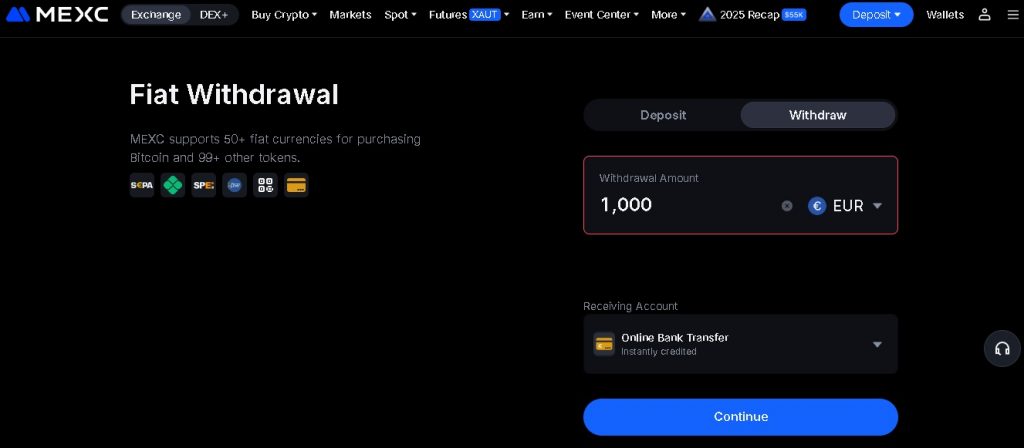

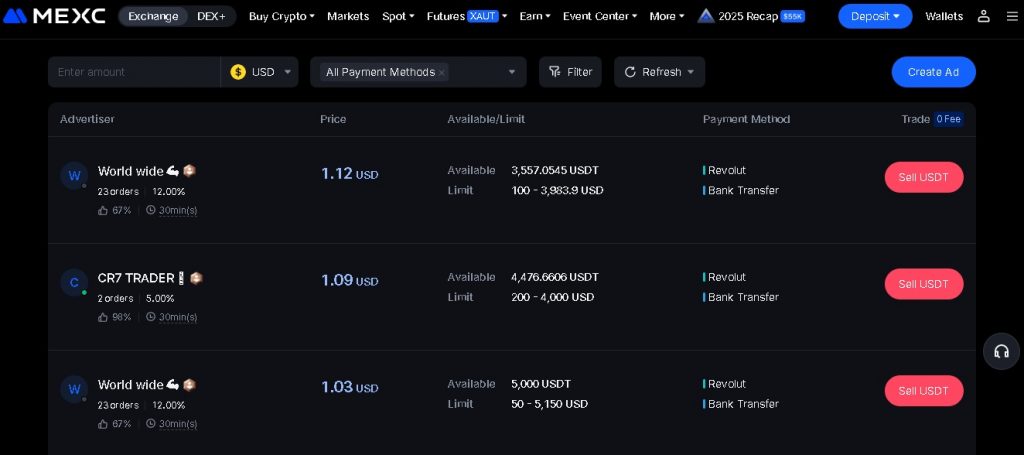

Fiat Withdrawal on Mexc: Is It Possible to Withdraw Money to a Card?

The question “how to withdraw from MEXC to a card” is one of the most frequent, as for many users, the ultimate goal is to obtain traditional money. It should be stated immediately that MEXC Global, like many other global crypto exchanges, does not provide direct fiat withdrawal services to bank cards or accounts in its own interface for all users. This function heavily depends on the user’s jurisdiction and the availability of partner services in their region.

The primary way to convert crypto assets into fiat and withdraw them is to use third-party payment gateways-partners integrated into the platform. In the “Buy/Sell Crypto” section or via the P2P platform (if available in your region), options to sell USDT, BTC, or other coins for your local currency with withdrawal to a bank account or card may be offered. The process looks as follows: you sell cryptocurrency to a provider, specify your card details, after which the fiat funds are credited to it within the timeframes agreed with the provider (from a few minutes to several banking days).

An alternative and often more profitable path is to withdraw cryptocurrency to another, locally-oriented exchange or P2P platform that has extensive fiat withdrawal capabilities in your country. For example, you can withdraw USDT via the TRC-20 network (to minimize the fee) from the MEXC exchange to withdraw money to your account on another platform, sell it there, and withdraw dollars, rubles, hryvnias, tenge, etc., in the usual way. This method requires performing more operations but often allows for a better rate and lower overall fees.

It is important to remember tax obligations. When withdrawing fiat, especially through official banking channels, information about the receipt of funds may become available to your country’s tax authorities. The responsibility for declaring income and paying taxes lies solely with the user. Before a large withdrawal, it is always worth studying the current offers from MEXC partners specifically for your region, comparing fees and limits.

Therefore, although direct withdrawal to a card within MEXC may be unavailable, the chain of operations “cryptocurrency from MEXC -> transfer to a fiat-supporting platform -> sale and withdrawal” is a standard and workable practice for most users worldwide.

Basics and Advanced Trading Strategies on MEXC

After registration, funding, and security setup, the key stage begins – actual trading. Understanding how to trade on MEXC effectively goes beyond simply pressing the “Buy” and “Sell” buttons. The platform provides a rich arsenal of tools for this, and their competent use separates a casual market participant from a systematic trader.

Let’s start with basic order types. In addition to standard limit (where you specify the price) and market (buying/selling at the best available price) orders, MEXC offers conditional orders. Stop-Loss automatically sells an asset when it reaches a certain price, limiting losses. Take-Profit closes a position upon reaching a target profit level. A particularly powerful tool is the OCO (One-Cancels-the-Other) order, which combines a limit take-profit and a stop-loss into one bundle: when one order is triggered, the other is automatically canceled. This is an ideal tool for risk management in the absence of constant market monitoring.

For market analysis, the built-in TradingView charts provide everything needed: dozens of technical indicators (from moving averages to complex oscillators), graphical analysis tools (trend lines, Fibonacci), and the ability to configure multiple timeframes. Experienced traders often use multiple monitors or workspaces to simultaneously track different pairs and indicators. Personally, I set up a separate workspace for monitoring volatility on new listings and another for long-term analysis of major trends on BTC and ETH.

MEXC offers several markets: Spot, Margin, and Futures. Spot trading is the foundation, where you buy assets in full ownership. Margin trading allows borrowing assets from the exchange (leverage) to increase position size. This increases both potential profit and losses. To access margin trading, you need to activate a margin account and pass a small test on understanding risks.

Trading strategies can vary from long-term investing (HODL) in promising altcoins, in your opinion, to high-frequency scalping on futures. The key to success is not in searching for a “magic indicator” but in developing a clear trading system that includes entry criteria, exit criteria (both for profit and loss), and capital management rules (e.g., risking no more than 1-2% of the deposit on one trade). MEXC provides the technical capabilities to implement almost any such system.

Passive Income and Additional Earning Opportunities

In addition to active trading, the platform has a range of tools for generating passive income, which is especially relevant during sideways market movements. Exploring how to earn on MEXC without constantly making trades opens access to less stressful but patience-requiring strategies.

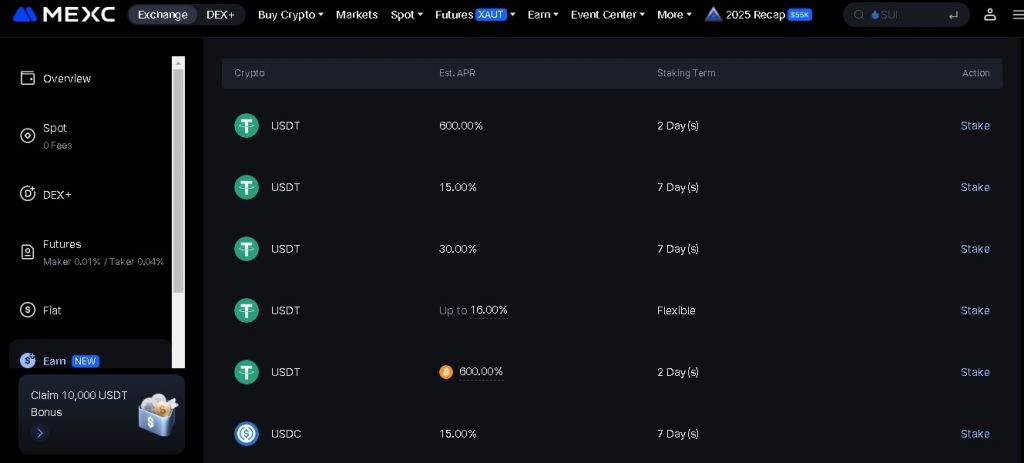

One of the main tools is staking and Earn products. In the “Earn” section, you can place your idle assets in various fixed-term or flexible-term products. These can be savings products with floating Annual Percentage Yield (APY), staking of PoS coins, or participation in DeFi pools. Yield varies depending on the asset, lock-up period, and market conditions. For example, staking Polkadot (DOT) or Cardano (ADA) can yield 5-10% per annum in the coin itself.

The Launchpad and M-Day programs provide users holding the MX token with the opportunity to participate in sales of new projects at an early stage, often at a lower price. Participation usually requires signing up for a raffle or locking up MX for a certain period. This is a high-risk but potentially high-reward way to earn, as the listing of a new token on the exchange is often accompanied by a sharp price increase. However, it is important to conduct your own analysis of such projects, as not all of them are successful.

Lending (Margin Lending) allows you to act as a lender on the margin market. You place your assets (e.g., USDT) in a lending pool, and the exchange lends them out to other traders as collateral for margin trading. For this, you receive interest, accrued daily. Yield depends on the demand for a particular asset for loans and can spike during periods of high market volatility when many traders want to open leveraged positions.

Thus, the MEXC ecosystem provides diverse ways to benefit from crypto assets. Combining active trading, staking for long-term assets, and participation in new project launches can form a balanced portfolio management strategy, where each tool plays its role in the overall picture of risk and return management.

The Internal MEXC Crypto Wallet: Functionality and Security

Every registered user automatically gets access to an internal MEXC crypto wallet for storing assets. It is important to understand that this is not a standalone application like Trust Wallet or MetaMask but an integrated account system on the exchange platform itself. Its main function is to provide quick access to funds for trading and other operations within the ecosystem.

The wallet is divided into several sub-accounts depending on the type of use: Spot Wallet, Futures Wallet, Margin Wallet, and Earn Wallet (for assets in staking). Funds can be transferred instantly and free of charge between these accounts within the platform. For example, to trade futures, you first need to transfer USDT from the spot wallet to the futures wallet. This separation is good practice, as it isolates funds involved in high-risk operations (futures) from core savings.

From a security standpoint, the funds in these wallets are under the exchange’s control. This means you trust MEXC with their storage under the “custodial wallet” model. The platform uses a combination of hot (online) wallets for operational needs and cold (offline) storage for the bulk of assets. This is a standard and generally reliable practice. However, the philosophy “Not your keys, not your coins” is fully applicable here. For long-term storage of large sums not intended for active trading, it is always recommended to use independent hardware or software wallets, the private keys of which belong solely to you.

The internal wallet’s functionality also includes a history of all transactions (deposits, withdrawals, internal transfers, trading operations), which is convenient for accounting and tax reporting. You can set up alerts for balance changes. For multi-currency storage, the wallet supports all coins traded on the platform, eliminating the need to create separate addresses for each asset, as with some blockchain wallets.

Thus, the internal MEXC wallet is primarily a convenient and efficient tool for trading, but it should not be considered the primary and sole place for long-term crypto savings. Its role is to be an operational base for trading activities, while the function of a “safe” should be delegated to more secure and independent solutions.

Direct and Alternative Methods for Depositing on Mexc

We have already touched on deposit methods, but let’s examine this process in more detail, as it is the starting point for any activity. After you have completed registering on MEXC, the first step is to fuel your account – with cryptocurrency.

The most direct way is a cryptocurrency deposit from an external address. In your account, selecting the desired coin, you get a deposit address. For networks that use a memo/tag system (e.g., XRP, XLM, ATOM), this identifier is critically important: an error will lead to loss of funds. Always copy both the address and the memo, if provided. After sending the transaction from the external wallet, wait for the required number of network confirmations. To save time and fees, many users choose networks with low fees and high speed for transfers, such as Tron (TRC-20) or Binance Smart Chain (BEP-20), especially for stablecoins like USDT or USDC.

An alternative is using the P2P platform (if active in your region). Here you can buy cryptocurrency (most often USDT) directly from another user for fiat money. The process is similar to such services on other major exchanges: you choose a seller’s offer with a suitable rate and payment method (bank transfer, card, e-wallets), make the payment, and after the seller’s confirmation, USDT is credited to your balance. This method is good for an initial entry into cryptocurrency without using third-party exchangers.

The third option is fiat gateways through third-party providers (Simplex, Mercuryo, etc.). In the exchange interface, you specify the fiat amount you want to convert into cryptocurrency and go through the card payment process. Cryptocurrency (most often BTC, ETH, or USDT) is credited to your account automatically after successful payment. This is the simplest but most expensive method, as provider fees can be substantial, and the rate may not be the most favorable.

The choice of a specific method depends on your priorities: minimal fees (direct crypto deposit), convenience and simplicity (fiat gateways), or direct exchange for local currency (P2P). For an active trader who regularly funds their account, optimizing costs at the deposit stage is an important part of overall efficiency.

Comparative Analysis: MEXC Against Competitors

To assess the true place of MEXC in the cryptocurrency exchange ecosystem, it is useful to conduct a brief comparison with key competitors: Binance, Bybit, KuCoin, and OKX. Each of these platforms has its unique features, and the choice between them often depends on specific trader needs.

In the area of listing new coins, MEXC and KuCoin are undisputed leaders, often outpacing even Binance in the speed of adding new projects. This makes them indispensable for those engaged in trading at early stages. However, Binance offers a wider range of fiat services and regulated products in specific regions (e.g., Binance.US, Binance TR). In terms of liquidity depth for major pairs (BTC/USDT, ETH/USDT), the leader is usually Binance, followed by OKX, but MEXC confidently holds a top position, providing excellent order execution.

Futures platforms Bybit and OKX are traditionally considered very strong, with a polished interface and high liquidity. MEXC confidently competes with them in terms of provided leverage and contract selection, especially for altcoins. However, the community of professional futures traders often notes more stable operation and advanced analysis tools on Bybit and OKX. Regarding fee policies, all these exchanges offer similar models with discounts for holding native tokens (MX, BNB, OKB, KCS), and the choice here comes down to details and personal preference.

As for security and reputation, Binance, despite regulatory challenges, possesses the greatest trust from institutional players. OKX also has a long history. MEXC and KuCoin are perceived as more “risky” in the eyes of the conservative public precisely because of their aggressive listing policy, although there have been no serious hacks or fund losses in their history. User support is a weak point for all the listed platforms during periods of abnormal market activity, which, however, is a common growing pain of the entire industry.

Thus, MEXC does not aim to be an “exchange for everyone“. It clearly occupies the niche of a platform for experienced users and early investors who value breadth of choice, high leverage, and the ability to be among the first to access new assets. It perfectly complements a trader’s toolkit, who might also use Binance for fiat operations or Bybit for certain futures strategies.

Legal Aspects and Regulatory Status of the Mexc Platform

The issue of regulating cryptocurrency exchange activities is becoming increasingly acute. MEXC Global positions itself as a decentralized organization without a clear tie to a single country. The company’s headquarters were previously associated with the Seychelles – a jurisdiction popular among cryptocurrency enterprises due to liberal regulation. However, it is important to understand that this does not mean an absence of rules.

The platform implements global “Know Your Customer” (KYC) and “Anti-Money Laundering” (AML) standards. These measures are mandatory for users wishing to remove withdrawal limits or use certain services. In case of suspicious transactions or requests from law enforcement agencies under international law, the exchange may block an account or require additional documents confirming the source of funds. In my practice, I always recommend completing full verification and having documents confirming asset legality on hand to avoid potential delays at a critical moment.

Access to the exchange’s services for residents of various countries is restricted according to its internal policy and international sanctions lists. For example, users from the USA, Canada, Singapore, and a number of other countries cannot use the platform or have limited access (often only to spot trading without futures). During registration, the user must confirm that they are not a resident of a prohibited jurisdiction. Violating this rule may lead to account and fund freezing.

From a taxation standpoint, MEXC, like most exchanges, does not act as a tax agent for users. It provides a transaction history that can be exported for independent tax base calculation. The responsibility for declaring income from trading, staking, and other operations lies entirely with the user under the laws of their country of residence. For active trading, it is worth setting up an accounting process immediately, using built-in export tools or third-party services like CoinTracker or Koinly.

Thus, when working with MEXC, the user must be aware that they are interacting with a global platform operating in a complex and changing legal field. Compliance with KYC requirements, understanding restrictions for one’s country, and competent tax accounting are the three pillars on which legal and safe work with this and any other similar trading platform is built.

The MEXC Global cryptocurrency exchange is a complex, multifunctional organism that over the years has evolved from just another trading platform into a significant liquidity hub, especially for new digital assets. Its strength lies in providing access to tools that appear on other platforms with a delay. Its weakness is its orientation towards independent and prepared users who do not need constant hand-holding. A distinctive feature is the balance between aggressive listing and maintaining high technological reliability of the trading core. To extract maximum benefit from this platform, it is necessary to approach it as a professional tool: study it thoroughly, customize it for your tasks, and always adhere to strict risk management and security rules. In the hands of a disciplined trader or investor, MEXC becomes a powerful lever for implementing a wide variety of financial strategies in the world of digital assets.

Open an account and get advantages for new users!

📝

- 1Launchpad is a platform (often an exchange or a separate service) that helps new blockchain projects raise capital and investors find promising startups at an early stage, providing them access to token sales before listing (IEO, IDO, ICO), while ensuring project vetting, security, and liquidity. Projects receive funding and an audience, and investors get the opportunity to buy new tokens at a favorable price.

- 2M-Day (Day M) is an exclusive futures event on the MEXC cryptocurrency exchange, where traders can participate in a competition to earn futures bonuses and open “Wonderland Chests,” receiving rewards and tokens from new projects for achieving a certain trading volume (e.g., 45,000 USDT), which allows increasing potential profit and gaining access to new listings.

- 3An airdrop is the free distribution of tokens or coins to users as a marketing strategy to promote a new project, attract an audience, and increase awareness, often requiring simple tasks to receive: subscribing to social media, sharing a post, or simply holding another cryptocurrency in a wallet. It is a way for startups to expand their user base and for participants to obtain potentially valuable assets without investment, but caution is required due to the risk of fraud.

- 4Maker-Taker is a trading fee model on exchanges where a maker creates new liquidity (places a limit order waiting for execution), and a taker consumes it (instantly executes an existing order). Exchanges encourage makers with lower fees (sometimes even with rebates) because they improve the market, while takers pay more for speed and instant execution, taking away liquidity.