💰 Compound Interest Calculator

Calculate the growth of your investments with compound interest

📊 Calculation Results

Complete Guide to Using the Compound Interest Calculator for Investments and Savings

What is Compound Interest?

A = P × (1 + r/n)nt + PMT × [((1 + r/n)nt – 1) / (r/n)]

Compound interest is interest calculated on the initial deposit amount and on the accumulated interest of previous periods. This allows investments to grow exponentially over time.

Where:

A — final amount

P — initial investment amount

r — annual interest rate (in decimal format)

n — number of compounding periods per year

t — investment period in years

PMT — regular contribution

How to Use the Compound Interest Calculator to Achieve Financial Goals?

Compound interest — this is a financial phenomenon that Albert Einstein called “the eighth wonder of the world“, and to understand its power, special tools are needed. Our compound interest calculator is an intuitive online tool that allows anyone, regardless of financial literacy level, to forecast the growth of their investments. The first step to effectively using this tool is understanding the basic parameters you’ll be entering: initial amount, regular contributions, interest rate, and investment period.

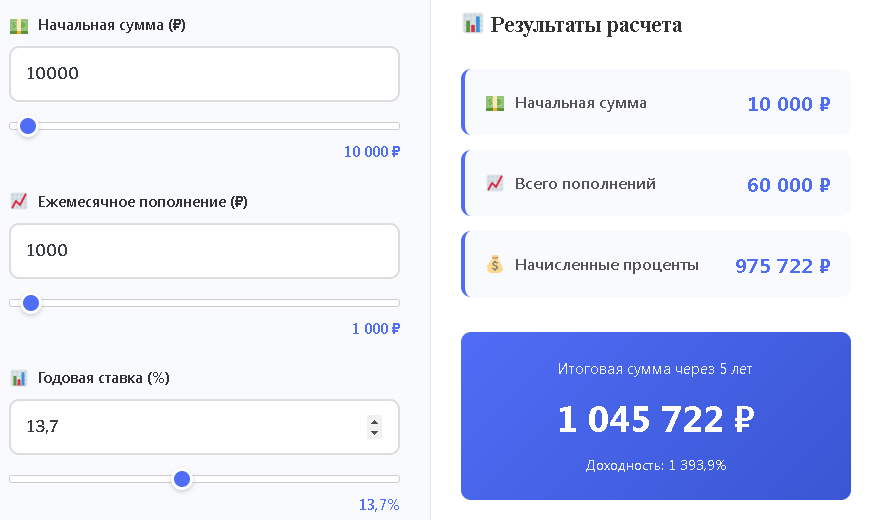

The calculator interface is designed with the needs of ordinary users in mind: all fields have clear labels, and visual sliders make it easy to experiment with different values. The special feature of our tool is that it shows not only the final result but also details the structure of savings — how much came from initial investments, how much was added during the process, and what profit was generated specifically by compound interest. This transparency helps make informed financial decisions.

The most important aspect of working with the compound interest calculator is testing various scenarios. What happens if you increase monthly contributions by 20%? How will the result change when choosing a different financial instrument with a different interest rate? Our tool provides instant answers to these questions, turning investment planning from a theoretical exercise into a practical financial management tool.

The final but critically important stage of working with the calculator is interpreting the results. When you see how relatively modest regular investments can turn into a significant amount thanks to the power of compound interest, it changes financial thinking. You begin to perceive investments not as short-term speculation but as a long-term wealth accumulation strategy where time becomes your main ally.

How to Calculate Compound Interest on a Deposit Using Modern Technology?

Calculating compound interest on a bank deposit historically required either complex mathematical calculations or consulting a financial advisor. Today, our online compound interest investment calculator solves this problem by providing instant and accurate calculations to any user. The calculation process begins with determining your deposit parameters: the amount of the initial deposit, the period for placing funds, and the interest rate offered by the bank.

The peculiarity of compound interest is that accrued interest is added to the principal deposit amount, and in the next period, interest is calculated on the increased amount. This mechanism creates a “snowball” effect, which our calculator clearly demonstrates. You can observe how with each compounding period the growth becomes more significant, especially over long time horizons — this is why long-term deposits with compound interest are so effective.

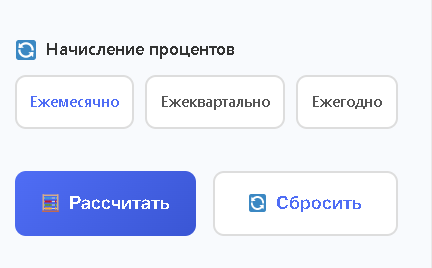

When calculating compound interest on a deposit, it’s important to consider the compounding frequency — how often accrued interest is added to the principal amount. Our tool allows you to choose between monthly, quarterly, and annual compounding, which corresponds to the offers of most modern banks. You immediately see how increasing the compounding frequency affects the final result, even while maintaining the same annual interest rate.

The practical application of these calculations goes beyond simple curiosity. Knowing how to calculate compound interest on a specific deposit, you can compare offers from different banks on an objective basis, identifying truly advantageous conditions. This knowledge transforms you from a passive consumer of financial services into an active participant in the financial market, capable of making decisions based on accurate numbers rather than marketing promises.

Online Compound Interest Investment Calculator: Technical Capabilities and Practical Application

A modern online compound interest investment calculator is much more than just a computational tool. It’s a comprehensive platform for financial modeling that takes into account numerous variables affecting the growth of your investments. The main advantage of our calculator is its ability to work with dynamically changeable parameters: you can observe in real time how adjusting any of the input values reflects on the final result.

The technical implementation of the calculator is based on precise mathematical formulas verified by financial science but presented in an accessible form. The algorithm considers not only the basic compound interest formula but also additional factors: regular portfolio contributions, the possibility of changing interest rates during the investment period, tax consequences (in advanced mode). This makes calculations as close as possible to real conditions.

The practical application of an online compound interest calculator is especially valuable for long-term financial planning. With its help, you can model various savings strategies: conservative with a fixed interest rate, moderate with the possibility of increasing contributions, aggressive with the search for instruments with higher returns. Each scenario immediately shows its effectiveness in numbers, simplifying the choice of optimal strategy for specific financial goals.

Integrating the calculator into the investment decision-making process creates a systematic approach to capital management. Instead of intuitive guesses or advice from unreliable sources, you get a clear mathematical model based on your individual parameters. This model becomes the foundation for justified decisions about asset allocation, choice of financial instruments, and determination of investment timeframes.

Free Compound Interest Calculator: Accessibility of Financial Modeling for Everyone

A free compound interest calculator removes barriers between complex financial concepts and ordinary people striving to improve their financial situation. In an era when financial consultations have become an expensive service, access to a quality financial modeling tool without any payments represents the democratization of financial knowledge. Our calculator is available 24/7, requires no registration, and is completely free — these characteristics make it an ideal tool for the mass user.

The philosophy behind providing such a powerful tool for free is simple: financial literacy should be accessible to everyone, not just those who can afford paid consultations. The compound interest calculator becomes an educational tool that in practice demonstrates the principles of financial markets, the importance of long-term planning, and the magic of compound interest. Each calculation is a mini-lesson in financial mathematics.

The technical side of the free calculator is in no way inferior to paid analogues. It uses the same mathematical models, provides the same calculation accuracy, and offers comparable functionality. The difference is only that we don’t monetize access to the tool itself, believing that spreading financial literacy is a socially significant task. This approach corresponds to the principles of open knowledge and accessible education.

The future of free financial tools, such as our compound interest calculator, is connected with their integration into broader financial planning ecosystems. We see development in the direction of personalizing recommendations based on entered data, adding functions for comparing different investment strategies, and creating mobile versions for “on-the-go” planning. All these improvements will remain free, preserving our commitment to the idea of accessible financial literacy.

How to Calculate Deposit Income Using a Compound Interest Calculator: Step-by-Step Instructions

Calculating income from a bank deposit using a compound interest calculator is a process that can be broken down into clear sequential steps.

The first step is determining the initial data: the amount you plan to place on deposit, the period for which you’re willing to part with the liquidity of these funds, and the interest rate offered by the bank. These three parameters are the foundation of any deposit profitability calculation.

The second step involves entering this data into the corresponding calculator fields. Special attention should be paid to the choice of compounding frequency — this parameter significantly affects the final result. Most modern calculators, including ours, offer options from daily to annual compounding. It’s important to choose the option that corresponds to the conditions of the specific bank offer you’re considering.

The third step is analyzing the obtained results. The calculator will show not only the total amount by the end of the deposit term but also its structure: how much was the initial amount, what was the total amount of accrued interest. This detailing allows you to understand which part of the final amount is the result of compound interest work, and which part is your initial investments. Such analysis is especially important for evaluating the effectiveness of a deposit as a savings tool.

The fourth step is comparative analysis. Using the calculator, you can quickly test several options: what happens if you increase the deposit term, find a bank with a higher interest rate, or choose a product with more frequent compounding? This ability to quickly compare transforms the compound interest calculator from a simple computational tool into a powerful means for making financial decisions.

Daily Compound Interest Calculator Formula: Mathematical Basis and Practical Value

The formula underlying the calculation of daily compound interest is an adaptation of the classical compound interest formula to daily compounding conditions. Mathematically it’s expressed as A = P × (1 + r/n)^(nt), where A is the final amount, P is the initial capital, r is the annual interest rate (in decimal expression), n is the number of compounding periods per year (365 for daily compounding), t is the term in years. This formula is the heart of any accurate compound interest calculator.

The practical value of understanding this formula lies in the ability to evaluate the real profitability of financial products. When a bank offers a deposit with daily compounding at a certain annual percentage, the daily compound interest formula allows calculating the effective annual rate, which usually turns out to be higher than the stated nominal rate. This difference can range from 0.1 to 0.5 percentage points depending on conditions — seems small, but over long horizons and significant amounts, this difference materializes into tangible money.

The peculiarity of the daily compound interest formula is its sensitivity to calculation accuracy. Even a small error in calculations, multiplied by a large number of compounding periods (365 times a year), can lead to a significant error in the final result. That’s precisely why using a specialized calculator is preferable to manual calculations or approximate estimates — it guarantees mathematical accuracy, critically important for financial planning.

The evolution of the compound interest formula continues along with the development of financial products. Modern calculators are beginning to account for additional variables: the possibility of changing interest rates during the deposit term, the influence of inflation on the purchasing power of the accumulated amount, tax deductions. These improvements make calculations even more accurate and practically useful, transforming the formula from an abstract mathematical expression into a working tool for financial management.

Compound Interest Savings Calculator: Strategic Planning of Financial Future

A compound interest savings calculator is a strategic-level tool that allows not just calculating the profitability of an individual deposit but designing a long-term financial strategy. Its main difference from simple compound interest calculators is the ability to work with variable parameters: changing amounts of regular contributions, adjustments of interest rates during the savings period, accounting for various financial goals with different time horizons.

Strategic application of the savings calculator begins with defining financial goals. These can be short-term goals (saving for vacation or a major purchase within 1-2 years), medium-term (forming a down payment for a mortgage in 3-5 years), or long-term (creating retirement capital in 10-30 years). For each goal, the calculator helps determine the necessary size of regular contributions at a given investment return.

The power of the savings calculator is revealed when modeling various life scenarios. What will happen to your savings if in five years you can increase monthly contributions by 30% thanks to career growth? How will temporary reduction of investments due to having a child or other financial obligations affect the final result? Answers to these questions turn abstract financial planning into a concrete action plan adapted to your life situation.

Integrating the savings calculator into the overall financial management system creates a holistic approach to wealth. You can simultaneously plan the achievement of several financial goals, distributing available resources among them optimally. This systemic thinking is the key advantage of people who use such tools not episodically but as part of regular financial practice. The result is not just a set of disparate savings but a harmonious financial ecosystem where each part supports the others.

Compound Interest Calculation Calculator: Architecture of Accuracy and Convenience

The architecture of a modern compound interest calculation calculator is built on three fundamental principles: mathematical accuracy, user convenience, and visual clarity. Mathematical accuracy is ensured by using verified financial formulas and algorithms that have undergone multiple testing in various conditions. Our calculator uses double calculation verification to exclude even minimal errors, which is critically important when working with long-term financial projections.

User convenience is achieved through an intuitive interface that requires no special knowledge to work with. Input fields are accompanied by clear prompts, visual sliders allow easy experimentation with parameters, and results are presented in a structured form where the role of each factor in the final result is immediately visible. Special attention is paid to the mobile version of the calculator, as more and more people engage in financial planning from mobile devices.

Visual clarity is what distinguishes an advanced compound interest calculation calculator from a simple computational tool. Dynamic graphs show how your investment grows over time, highlighting various components of this dynamics: initial capital, regular contributions, accrued interest. These visualizations help literally “see” the power of compound interest, which often proves more convincing than just numbers.

The technical development of compound interest calculation calculators is moving in the direction of greater personalization and integration with other financial tools. We’re working on features that will consider the individual tax status of the user, offer optimal portfolio rebalancing strategies, integrate with data about real financial products on the market. All these improvements will preserve the calculator’s main purpose — to be a reliable assistant in making financial decisions based on accurate calculations, not guesses or emotions.

Practical Application of the Compound Interest Calculator in Various Life Situations

The compound interest calculator finds practical application in diverse life situations, going far beyond simply calculating bank deposit profitability. For young professionals beginning their career path, this tool helps realize the importance of starting investments early. Even modest amounts regularly saved at the beginning of a professional journey, thanks to the power of compound interest over decades, can turn into capital providing financial independence.

For families planning major expenses — children’s education, home purchase, creating a financial safety net — the compound interest calculator becomes a tool for determining realistic timelines for achieving goals. It allows answering the question: “How much do we need to save monthly to accumulate the necessary amount in N years?” The answer, supported by accurate calculations, transforms abstract dreams into concrete financial plans with clear parameters.

For middle-aged people thinking about retirement provision, the compound interest calculator performs a critically important function — shows how even with a relatively late start to retirement savings, one can achieve a decent standard of living after ending a career. The key factor here becomes not so much the size of monthly contributions but the choice of instruments with optimal risk-return ratio, as well as discipline in following the chosen strategy.

For entrepreneurs and self-employed professionals, the compound interest calculator serves as a business planning tool. It helps determine what portion of profit is advisable to reinvest in business development, and what portion to direct to personal investments for creating personal capital independent of business risks. This balance between investments in business and in personal assets is one of the most complex tasks of financial management for entrepreneurs, and the compound interest calculator provides an objective numerical basis for its solution.

Methodological Foundations of Compound Interest Calculator Operation

The methodological basis of modern compound interest calculators combines mathematical rigor and practical orientation. At the theoretical level, these tools rely on the time value of money theory — a fundamental financial concept according to which money today is worth more than the same amount in the future due to its potential earning capacity. The calculator quantitatively expresses this concept, showing how current investments can grow over time.

At the level of mathematical models, calculators use both standard compound interest formulas for situations with constant parameters and more complex iterative algorithms for cases with changing variables. For example, when calculating savings with gradually increasing regular contributions (reflecting investor career growth), algorithms are applied that step by step calculate the result for each period with its unique parameters.

The practical methodology of working with the calculator includes the principle “from simple to complex“. Beginner users are recommended to first master basic scenarios with constant parameters to feel the general patterns of investment growth under the influence of compound interest. Then you can move to more complex models including interest rate changes, irregular contributions, accounting for inflation and tax consequences. This gradual approach ensures deep understanding of the tool’s capabilities.

The methodological development of compound interest calculators is moving in the direction of greater integration with real economic conditions. Prospective models are beginning to account for not only nominal but also real (adjusted for inflation) interest rates, correlations between different asset classes in an investment portfolio, probabilistic scenarios of market condition changes. These complications make calculations more realistic, although they require from the user a higher level of financial literacy for correct interpretation of results.

Compound Interest Calculator as the Foundation of Financial Literacy and Conscious Planning

The compound interest calculator has evolved from a simple computational tool into a comprehensive platform for financial education and planning. Its significance goes beyond the technical function of calculating numbers — it becomes an “exercise machine” for financial thinking that helps develop discipline of regular investments, understanding of long-term financial processes, and the ability to make decisions based on numbers, not emotions. In a world where financial decisions become more complex each year, such an exercise machine becomes a necessary element of personal financial infrastructure.

The educational role of the compound interest calculator is especially important in conditions when formal financial education is not available to everyone. The tool in accessible form demonstrates key investment principles: the importance of starting as early as possible, the value of contribution regularity, the power of long-term perspective. Each experiment with calculator parameters is a mini-research that expands the user’s financial horizons and increases their confidence in managing personal finances.

The social significance of widespread distribution of tools like our compound interest calculator lies in reducing inequality of financial opportunities. When every person, regardless of income level and education, gets access to a quality financial planning tool, this creates prerequisites for more equitable distribution of economic opportunities. Financial literacy, supported by practical tools, becomes a factor of social stability and economic development.

The future of compound interest calculators is connected with their integration into broader digital ecosystems of personal financial management. We see prospects in creating smart assistants that not only calculate numbers but also offer personalized recommendations based on analysis of user financial behavior, current market conditions, and long-term financial goals. These assistants will learn from interaction with the user, becoming increasingly accurate in their forecasts and recommendations. However, their core will always remain the classical yet eternally relevant compound interest formula — a mathematical expression of one of the most powerful economic laws which, with proper understanding and application, can change the financial destiny of any person.