Order trading is a fundamental concept in financial markets, denoting the process of placing instructions (orders) to buy or sell a financial asset (currency, stock, cryptocurrency, etc.) through a broker’s trading platform. These instructions define the conditions under which a trade should be executed: price, volume, and time. The use of various order types is a cornerstone of modern trading strategy, allowing traders to automate their actions, manage risks, and act disciplined without constantly being in front of the monitor. Understanding the mechanics of orders is essential for both beginners and professional market participants.

Order trading is a fundamental concept in financial markets, denoting the process of placing instructions (orders) to buy or sell a financial asset (currency, stock, cryptocurrency, etc.) through a broker’s trading platform. These instructions define the conditions under which a trade should be executed: price, volume, and time. The use of various order types is a cornerstone of modern trading strategy, allowing traders to automate their actions, manage risks, and act disciplined without constantly being in front of the monitor. Understanding the mechanics of orders is essential for both beginners and professional market participants.

What is an order in trading

An order in trading is a formalized command that a trader gives to their broker or trading platform to execute a trade in the financial market. Essentially, an order is a set of strict parameters that define what, when, and in what quantity should be bought or sold. Without an order system, the market would be a chaotic environment where all trades would be executed manually at the current price, making planning and risk management impossible.

Every order contains several key attributes. The main ones are: the type of asset (e.g., Apple Inc. stock), action (buy or sell), lot size (trade volume), and the type of order itself (market, limit, etc.). It is the order type that dictates the conditions for its execution. Traders use orders not only to enter a trade but also to exit it—both with profit and loss, making them a universal tool for managing the entire lifecycle of a trading position.

The evolution of orders is closely linked to the development of electronic trading systems. Whereas in the era of open outcry trading, orders were shouted in the pit, today they are transmitted digitally in fractions of a second. This has enabled the creation of complex order types that can reside in the system for weeks, waiting for specified conditions to be met. Thus, an order is not just a command, but a strategic tool that brings a trading plan to life.

The importance of orders cannot be overstated from the perspective of trading psychology. They allow the elimination of the emotional component at the moment of decision-making. The trader determines entry and exit points in advance, in a calm environment, and the market then independently executes their plan. This disciplines and prevents spontaneous, often loss-making, decisions caused by greed or fear.

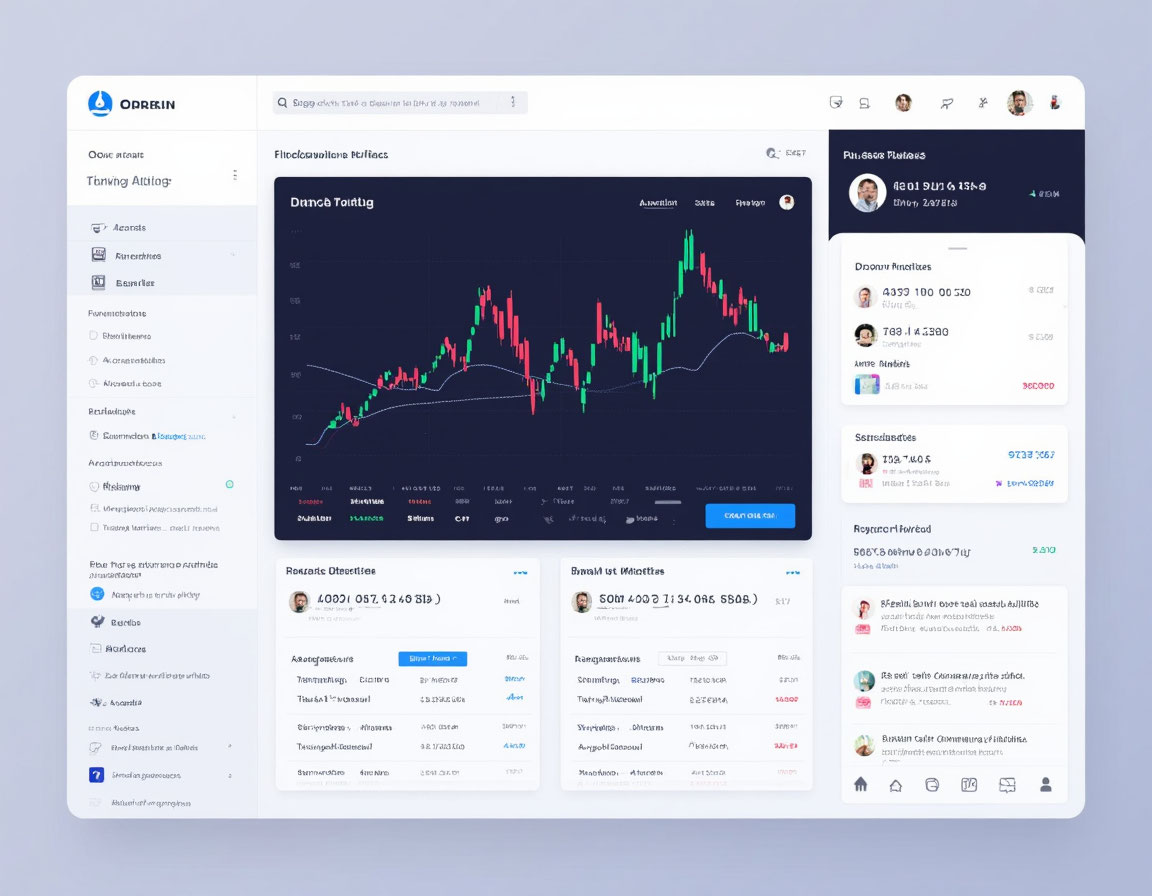

In modern trading terminals like MetaTrader, Thinkorswim, or Quik, the interface for placing orders is a central element. It gives the trader full control over all parameters of the future trade. Understanding how to correctly place an order is the first practical step for anyone starting their journey in the financial markets.

Types of orders in trading

The variety of trading strategies and market conditions has led to the emergence of different types of orders, each serving to solve specific tasks. All of them can be roughly divided into two broad categories: orders for immediate execution and pending orders. Orders for immediate execution, as the name implies, are intended to execute a trade at the current market price at the moment they are submitted. The main representative of this category is the market order.

The second major category consists of pending orders. These are instructions placed in the trading system for execution in the future when certain conditions are met, primarily when the price reaches a specified level. Pending orders include limit orders, stop orders, take profit, and trailing stop. Their key advantage is automation, allowing the trader not to constantly monitor the charts.

In addition to the basic division, orders can be classified by their primary function: for market entry, for limiting losses (stop-loss), or for securing profit (take-profit). Some orders, such as OCO (One Cancels the Other) and IF-THEN, are conditional and create combinations where the activation of one order automatically cancels the other. These are advanced tools for building complex trading systems.

The choice of a specific order type directly depends on the trading strategy. A scalper working on short time frames may prefer market orders for instant entry. A long-term investor, on the contrary, will actively use limit orders to buy assets at a favorable, predetermined price, ignoring the current market volatility.

Thus, the “landscape” of orders in trading is quite diverse. The ability to competently combine different types is a sign of a professional approach to trading. It allows not only for effectively capturing price movements but also for creating robust systems for money and risk management, which is the key to long-term success in the market.

Market Order

A Market Order is an instruction to a broker to buy or sell an asset at the best available price on the market at that particular moment. It is the simplest and fastest way to open or close a position. Its main characteristic is speed and guaranteed execution, but not a guaranteed price. When a trader places a market order, they are essentially stating: “I need to enter the trade right now, and I agree to the price the market offers.”

The execution mechanism of a market order involves matching it with opposite orders in the order book (market depth). A buy order will be executed at the Ask price (the offer price), and a sell order will be executed at the Bid price (the bid price). The difference between these prices is called the spread, and this is the primary cost a trader pays for using a market order.

The main advantage of a market order is its immediate execution. In a fast-moving market where every second counts, for example, during the release of important news, this can be critical. It is ideally suited for situations where a trader needs to guaranteed enter or exit the market, regardless of minor price fluctuations.

The main disadvantage of this order type is slippage. During periods of high volatility or low liquidity, the execution price of a market order can differ significantly from the one the trader saw on the chart at the moment of placing it. The order may be executed at several prices as it “takes” liquidity from the order book until its volume is fully satisfied.

Despite the risk of slippage, market orders remain one of the most popular tools, especially among novice traders, due to their simplicity. However, experienced market participants use them with caution, preferring more controlled order types like limit orders in calm market periods.

Limit Order

A Limit Order is an instruction to buy or sell an asset at a strictly specified price or better. Unlike a market order, the priority here is control over the price, not the speed of execution. A buy limit order will only be executed at the specified price or lower, and a sell order at the specified price or higher.

The principle of a limit order is that it is placed in the order book and waits there until the market price reaches the specified level. For example, if a stock is trading at $150, a trader can place a limit order to buy at $148. If the price drops to this level, the order will be executed. This allows buying assets “on the dip” and selling “on the rise,” which is the basis of many value investing and swing trading strategies.

The key advantage of a limit order is full control over the entry or exit price. The trader knows in advance at what price the trade will be executed, which eliminates slippage (under normal liquidity conditions). Furthermore, by using limit orders, the trader often gets a better price than the current market price.

The main risk associated with limit orders is the risk of non-execution. The market price may never reach the set level and reverse in the desired direction without the trader’s participation. In this case, potential profit will be missed. This type of order requires foresight and an understanding of support and resistance levels from the trader.

Limit orders are widely used for accumulating positions in a certain price range, as well as for taking profit. They are an indispensable tool for any trader who strives to trade disciplined and minimize transaction costs associated with spread and commissions.

Stop Order

A Stop Order, also known as a Stop-Loss, is a pending order that turns into a market order once the asset’s price reaches a certain level, called the stop price. Its main function is to limit losses on an already open position. It is one of the most important risk management tools in any trader’s arsenal.

How does it work? If a trader bought an asset at $100, they can place a stop order to sell at $95. If the price falls and reaches $95, the order is activated and turns into a market order, selling the asset at the best available price at that moment. This allows limiting the loss to approximately $5 per unit of asset (minus commissions and possible slippage).

Besides limiting losses, stop orders can be used to enter the market. Such an order is called a buy stop order. It is placed above the current market price and is used to enter a long position when the price breaks through a key resistance level, confirming the trend’s continuation. Similarly, a sell stop order is placed below the current price to enter a short position when support is broken.

The main advantage of a stop order is discipline and capital protection. It forcibly closes a losing trade, not allowing emotions to hope for a market reversal. Without a stop order, one unsuccessful trade can lead to catastrophic losses. It is a kind of “insurance policy” for the trader.

The disadvantage of a stop order, like any market order it turns into, is the risk of slippage. During sharp market movements, especially during gaps (price gaps), the execution price can be significantly worse than the stop price. To minimize this risk, some traders use stop-limit orders, which turn into a limit order instead of a market order, but this carries the risk of non-execution.

Take Profit

A Take Profit is a pending order designed to automatically secure profit on an open position when the price reaches a predetermined target level. When the price reaches this level, the order is executed, and the position is closed. Using a take profit allows the trader to formalize their profit-taking plan and avoid the temptation to close the trade prematurely or, conversely, to get greedy hoping for even more growth.

The principle of take profit is similar to a limit order. For a long position (buy), the take profit sell order is placed above the current market price. For a short position (sell), the take profit buy order is placed below the current price. Once the market reaches the specified price level, the order triggers, locking in the planned profit.

The main advantage of take profit is the automation of the profit-taking process. The trader does not need to constantly monitor the chart and decide when to close the position when the market is moving in their favor. This eliminates the emotional component—fear and greed, which often cause traders to violate their own trading system.

Another important purpose of take profit is to maintain a positive risk/reward ratio. By setting a take profit at a distance two or three times greater than the stop-loss, the trader sets up their trade for positive mathematical expectation in advance. Even if some trades are loss-making, the overall result will remain positive.

The disadvantage of take profit is that it may close a trade before the trend exhausts its potential. The price, having reached the target level and triggered many take profit orders, may reverse and continue moving in the original direction. To combat this, some traders use the technique of partially closing a position, securing part of the profit at one level and leaving the other part with a trailing take profit.

Trailing Stop

A Trailing Stop is an advanced dynamic type of order that combines the functions of a stop-loss and a take profit. Unlike a static stop order, which is fixed at one price level, a trailing stop automatically moves following the price when it moves in a direction favorable to the trader. This allows securing profit on a trend reversal without limiting its potential growth.

The mechanics of a trailing stop are based on setting a certain distance (in pips, percentages, or in the account currency) from the current market price. For example, a trader sets a trailing stop 50 pips below the price for a long position. If the price rises, the stop level pulls up, maintaining a distance of 50 pips. If the price starts to fall, the stop level remains at the achieved maximum, and when the price falls 50 pips from this maximum, the order to close is triggered.

The main advantage of a trailing stop is the ability to “let profits run.” It is ideally suited for strong trending movements where it is impossible to predict exactly where the trend will end. A trailing stop allows capturing a significant part of the movement, automatically protecting accumulated profit during a correction.

This order type is a powerful psychological tool. It relieves the trader of agonizing questions: “Is it time to take profit?” or “Maybe wait a bit longer?”. The system does everything automatically according to the set parameters, maintaining discipline and removing emotions from the decision-making process.

The main disadvantage of a trailing stop is that in a sideways or volatile market, it may prematurely close a position due to minor pullbacks. Also, depending on the platform, the trailing stop may be “client-side”—meaning it is only active when the trading terminal is running, which requires a constant network connection.

What is a limit order in trading

A limit order in trading is a tool that gives the trader full control over the execution price of a trade. It is an instruction to the broker to execute a deal only at the specified price or better. This makes it the antithesis of a market order, where the priority is immediate execution at the expense of price control.

The process of a limit order can be compared to placing a “trap order” in the order book. When a trader places a limit order to buy, they are telling the market: “I am willing to buy this asset, but not for more than X.” Sellers, in turn, seeing this order, may agree to the offered price if their interests coincide with the buyer’s. This creates transparency and ensures fair pricing.

From a strategy perspective, limit orders are the cornerstone of the “buy the dip, sell the rally” approach. They allow accumulating positions near support levels (for buying) and resistance levels (for selling), which is the basis of many disciplined trading methodologies. Furthermore, large institutional players often use limit orders to enter large positions without significantly impacting the market.

An important aspect is the difference between a limit order to buy and a limit order to sell. A limit order to buy is always executed at the limit price or lower, which is beneficial for the buyer. A limit order to sell is executed at the limit price or higher, which is beneficial for the seller, respectively. This rule is fundamental to understanding the mechanics of the order.

In conclusion, a limit order is a tool for patient and calculating traders. It requires an understanding of market microstructure and price levels but rewards its user with better entry and exit prices, reduced transaction costs, and increased overall efficiency of the trading system in the long run.

What are pending orders in trading

Pending orders in trading are a category of orders that are not executed immediately but are activated when predetermined conditions occur, usually related to the price reaching a certain level. They are the primary tool for automating trading, allowing traders to implement their strategies without the need for constant market monitoring.

Pending orders include all orders described above, except for the market order. These are limit orders, stop orders, take profits, and their combinations. Each of them is placed in the trading system and remains there in a “dormant” mode until the market situation satisfies the conditions specified in it. Upon activation, they are either executed or turn into orders of another type.

The main value of pending orders lies in their strategic flexibility. A trader can set dozens of orders on different instruments and at different price levels in a few minutes, creating a complex trading network (grid). This is especially popular in strategies based on the assumption that the price will fluctuate within a certain range.

Another key advantage is discipline. Pending orders strictly follow a pre-defined plan. A trader who has determined their entry points, stop-loss, and take-profit places the corresponding orders and can step away from the chart. This prevents the detrimental influence of emotions, such as the fear of missing out (FOMO) or the hope for a reversal of a losing position.

It is important to understand that pending orders do not provide a 100% execution guarantee. In fast market conditions (e.g., during a gap), the price may jump over the order’s activation level, and it will not be executed. Additionally, brokers may set restrictions on the distance for placing pending orders from the current market price. Nevertheless, they remain an indispensable tool for the modern trader.

What is a stop order in trading

A stop order in trading is, first and foremost, a risk management tool. Its primary and most important purpose is to limit potential losses on an open trade. In professional circles, there is an axiom: “Never open a trade without a set stop order.” This rule is the foundation of preserving trading capital.

A stop order works as an emergency exit mechanism. It is set at a level where the initial trading idea is recognized as incorrect. For example, if a trader bought a stock expecting a rise from a support level, then the stop order is placed just below that level. A break of support means the market hypothesis did not work, and the position should be closed with a minimal loss.

In addition to its protective function, the stop order is also used to open positions. A buy stop order, placed above the current price, allows entering the market when an uptrend is confirmed, for example, when breaking through an important resistance level. Similarly, a sell stop order below the current price is used to enter a short position when support is broken, signaling a strengthening downtrend.

Placing a stop order is an art that requires considering the asset’s volatility. If the stop is set too close to the entry price, it may be triggered by random market “noise” (a false breakout). If it is placed too far away, it will lead to an unjustifiably large loss if triggered. Many traders use technical indicators such as Average True Range (ATR) or key chart levels to determine the stop level.

In the end, a stop order is not just a “button” to close a loss. It is a strategic tool that defines the risk per trade (R – risk), which is the basis for calculating position size and money management. Competent use of stop orders is one of the main signs of a professional approach to trading.

What is a Take Profit order in trading

A Take Profit order in trading is a tool for systematically securing profit. If a stop-loss defines the point where a trader admits their mistake, then the take profit marks the point where they record their success. This order allows profit to be realized automatically when the price reaches the target level defined in the trading plan.

The philosophy of take profit is based on the principle that “greed is the trader’s enemy.” Without a pre-set profit-taking level, a trader often succumbs to emotions: they may close a successful trade prematurely due to fear of a pullback or, conversely, hold the position for too long hoping for further growth, eventually watching the profit turn into a loss. Take profit eliminates this dilemma.

From a technical point of view, a take profit is a type of limit order. For a long position, it is a limit sell order placed above the opening price. Its execution guarantees that the asset will be sold at the target price or higher. For a short position, it is a limit buy order placed below the opening price.

Determining the level for take profit is a key part of building a trading system. It can be based on technical analysis (Fibonacci levels, chart patterns, trend lines) or on calculating the risk/reward ratio. For example, if a trader risks 50 pips (stop-loss), they might set a take profit at 100 pips (a 1:2 ratio) or 150 pips (a 1:3 ratio).

Thus, take profit is not just a way to take money off the table. It is a tool that forces the trader to think in advance about the potential profitability of their idea and relate it to possible losses. Regularly achieving the goals set by take profit has a positive impact on the trader’s psychological state, strengthening confidence in their system.

What is a Trailing Stop order in trading

A Trailing Stop order in trading is a dynamic tool that automatically moves the stop-loss level following the price moving in a favorable direction. Its task is to protect constantly growing profits, while allowing the position to remain open and participate in further trend movement. It is a compromise between premature profit-taking and the risk of giving back all profits on a reversal.

The principle of a trailing stop is best illustrated with an example. Suppose a trader buys an asset at $100 and sets a trailing stop at a distance of $10. Initially, the stop will be at $90. If the price rises to $110, the stop will move to $100 (breakeven). If the price continues to rise to $120, the stop will rise to $110. If the price then reverses and falls to $110, the position will close with a $10 profit. If the trend continues, the stop will continue to “creep” after the price.

There are several types of trailing stops, differing in how the distance is set. A fixed trailing stop is set in pips or in the account currency (e.g., 50 pips). A percentage trailing stop lags the price by a specified percentage of its current value. The most advanced versions can be tied to moving averages or other indicators that themselves dynamically adapt to volatility.

The main advantage of a trailing stop is the ability to extract maximum benefit from a strong trending movement. It is ideally suited for trend-following strategies where it is unknown in advance how far the price can go. At the same time, it provides psychological comfort, as the trader knows their profit is protected, and they don’t need to manually move the stop.

The main drawback is the possibility of premature exit from a position on corrections. In a volatile market, the price may pull back a distance sufficient to trigger the trailing stop and then reverse and continue moving in the original direction. To soften this effect, traders often use a wide trailing stop based on volatility (e.g., using ATR).

What is order flow in trading

Order Flow, or the flow of orders, is a method of market analysis that studies real market orders to buy and sell in real-time. Unlike classical technical analysis, which works with already formed prices on a chart, order flow provides insight into the forces behind these movements—supply and demand at the micro-level.

Data for order flow analysis comes from the market depth (Level II) and the time and sales tape (Time & Sales). The market depth shows all current limit orders to buy and sell with specified volumes. The time and sales tape displays the history of executed trades: at what price, in what volume, and at what time an asset was bought or sold. By analyzing this data, a trader can see where large players are concentrated.

Key concepts of order flow include identifying volume clusters (a concentration of a large number of trades at a certain price level), detecting absorption (a situation where a large order “absorbs” all liquidity at a level), and analyzing the delta (the difference between the volume of market buy and sell orders over a certain period). A positive delta often indicates the predominance of buyers.

The advantage of trading based on order flow is the ability to predict price movement before it is reflected on the chart. For example, if large limit sell orders are visible at a certain resistance level, but market buy orders are actively “absorbing” them, this may signal an imminent breakout of the level. This gives the trader an informational advantage.

However, order flow analysis is a complex and labor-intensive process requiring constant concentration and a deep understanding of market microstructure. It is more suitable for intraday traders and scalpers who make many trades during the day. For long-term investors, this method has limited practical value.

The correct order block in trading

A correct Order Block in trading is a concept from Smart Money Concepts (SMC) that identifies zones on the chart where large institutional players (smart money) placed their significant limit orders, leading to strong and directed price movements. These zones are considered high-probability levels for future reversals or trend continuations.

An order block is formed after a powerful impulsive movement that “sweeps” liquidity. It represents the last candle or group of consolidation candles immediately before this strong movement. It is believed that it is in this zone that “smart money” placed the bulk of their orders before initiating a large move.

There are two main types of order blocks: bullish (Bullish Order Block) and bearish (Bearish Order Block). A bullish order block is the zone before a strong upward movement, which subsequently acts as support. A bearish order block is the zone before a strong downward movement, which later becomes resistance. Price often shows respect for these levels, bouncing off them or consolidating near them.

The correctness of an order block is determined by several criteria. First, it must be formed before a strong, preferably breakout, movement. Second, the block itself should be relatively narrow in range. Third, when the price returns to this block, a reaction should be observed—a bounce or a slowdown in movement (consolidation).

The trading logic based on order blocks is that institutional players will protect their initial positions. If they bought in a certain zone (bullish block), then when the price returns to this zone, they will likely buy again to average down or add to their position, causing a new rise. Thus, order blocks give the trader an opportunity to “look at the cards” of big capital.

How to find order blocks in trading

Finding order blocks in trading is a skill that requires an understanding of the context of market movement and practice in chart analysis. The identification process can be broken down into several sequential steps that allow for identifying significant levels where “smart money” acted with a high degree of probability.

The first step is to identify a strong, directed impulsive movement (large candles, often with small or no wicks). This movement is called the “impulse” or “shift.” It indicates aggressive activity by large players.

The second step is to look to the left against this impulse to the moment it began. It is necessary to find the last candle or a compact group of candles (consolidation zone) immediately before the start of this powerful movement. This very zone is the presumed order block. For a bullish block, look for the candle/candles before the upward impulse; for a bearish one, before the downward impulse.

The third step is to accurately determine the block’s boundaries. The classical approach suggests that the order block is bounded by the high and low of that candle (or group of candles). Some traders use only 50% of the candle’s body for entry. The key rule: the price must completely leave this block before forming the impulse, meaning the block must be “broken.”

The fourth step is validation. The found order block gains strength if the price returns to it in the future and shows a clear reaction: a sharp bounce, the formation of a reversal candlestick pattern (e.g., a pin bar or engulfing), or at least a slowdown in movement and consolidation. The more times the price has reacted to this level in the past, the more significant it is considered.

To facilitate the search, many traders use special indicators that automatically mark order blocks on the chart. However, manual search and analysis are considered more valuable as they allow for a deeper understanding of the market context and filtering out false or weak blocks. Practicing on historical data is the best way to learn how to find quality order blocks.

What is order volume in trading

Order volume in trading is a quantitative characteristic showing how many lots (units of the base asset) a trader intends to buy or sell within a single trade. It is one of the three pillars on which any order stands, along with direction (buy/sell) and price. Volume directly determines the size of potential profit or loss from a trade, as well as its impact on the market.

Depending on the asset, volume can be measured in different units: lots (in stock and Forex markets), contracts (in the futures market), coins or tokens (in the cryptocurrency market). For example, 1 standard lot on Forex is equivalent to 100,000 units of the base currency. For retail traders, mini-, micro-, and nano-lots are also available, allowing trading with smaller amounts.

Order volume is a key element of money management (Money Management). Risk management rules dictate that the position size should be calculated based on the stop-loss size and the allowable risk per trade (usually 1-2% of the deposit). The formula looks like this: Volume = (Allowable risk in money) / (Distance to stop in pips). This prevents catastrophic losses.

From the perspective of market impact, order volume is divided into two types. Orders from retail traders usually have small volume and do not have a noticeable impact on the price (they are called “trading into liquidity”). Large orders from institutional players, on the contrary, can move the market. To hide their intentions, large players often break a large order into many small ones (algorithmic trading).

In conclusion, choosing the volume is not just about entering a number into the terminal. It is a strategic decision that links analysis, psychology, and the mathematics of trading. Correctly determining the order volume allows trading comfortably without exposing the deposit to excessive risk and is a mandatory skill for any serious trader.

What is a market order in trading

A market order in trading is an instruction for the immediate execution of a trade at the best available bid (for selling) or ask (for buying) prices at the current moment. It is the most direct and fastest way to enter or exit the market. When a trader places a market order, they sacrifice control over the exact execution price in favor of speed and the guarantee that the trade will be completed.

The execution of a market order occurs by absorbing liquidity from the order book. Imagine the order book for a stock shows buy orders (bid) at $100.00 and sell orders (ask) at $100.05. If a trader places a market order to buy, their order will be executed at $100.05, taking the offer off the market. The spread size ($0.05 in this case) is the direct commission for using a market order.

The main advantage of a market order is its immediate execution. In situations where time is critical, for example, when negative news is released and a position needs to be closed quickly, or when trading news when the price moves very fast, a market order becomes the only right choice. It guarantees that the trader will not be left “out of the market.”

The main and most significant disadvantage is slippage. Under conditions of low liquidity or high volatility, the difference between the expected price and the actual execution price can be significant. A market buy order may be executed at increasingly higher prices as it “eats” the supply in the order book, and vice versa.

Despite the risks, market orders hold an important place in trading. They are simple to use, making them popular among beginners. Experienced traders also resort to them when their strategy requires immediate entry or exit, but they do so with regard to the current market liquidity and volatility to minimize the negative effects of slippage.

Conclusion in simple words

An order in trading is, essentially, your instruction to the broker, a command to “do this and that.” Imagine you are ordering food in a restaurant: you tell the waiter what you want, how much, and sometimes at what price (if there’s a promotion). An order is your request in the financial market. Without this system, trading would be impossible.

All orders are divided into two large groups: “do it now” and “do it later when the price becomes such and such.” A market order is “do it now”; it is executed instantly, but at the available price, without guarantees. All other orders (limit, stop) are “do it later.” You agree with the market in advance at what price you are willing to buy or sell and wait.

The most important thing about using orders is risk management. A stop-loss (stop order) is your safety fuse. It automatically closes a trade with a small loss if everything goes wrong, preventing you from losing everything. A take profit is your goal; it automatically secures profit, preventing you from getting greedy and losing it all. These two orders are the foundation of survival in the market.

More complex orders, like trailing stop, help “let profits run,” automatically pulling the stop-loss behind the rising price. Analyzing order flow and order blocks is already advanced-level, an attempt to look at the cards of large banks and funds to understand where they are buying and selling.

In the end, the ability to use orders is not just a technical skill. It is the basis of trading discipline. By placing orders in advance, you trade according to a plan, not under the influence of emotions—fear and greed. You turn gambling into a systematic business with clear rules of entry and exit. It is this, in the long run, that separates successful traders from those who constantly lose money.