Exchange: A Complete Beginner's Guide from a Practitioner with 12 Years of Experience" />

How to Start Trading on the Exchange from Scratch: Myths and Reality of the Start

When I see the query “how to start trading on the exchange from scratch,” I envision someone who has never held a stock quote in their hands. That’s normal. A zero level means a lack of experience, not a lack of money or intelligence. The first thing you must do is give up illusions. Earning 100% per annum without risk is impossible. How can an ordinary person start trading on the exchange? By realizing that it is work. I don’t want to scare you; I want to give you a realistic picture.

In 2019, a client came to me; let’s call him Dmitry. He was eager to trade intraday. I asked him: “How many hours are you willing to study?“. He replied: “Well, a week.” A month later, having lost 40% of his deposit, he returned to index investing. The moral: starting from scratch is not about finding a magic strategy. It’s about learning the basics: how a stock differs from a bond, what a stop-loss is, and why dividends don’t guarantee portfolio growth.

My recommendation for the “zero” stage: don’t open a demo account right away. First, read the annual reports of companies like Apple or the reports of the New York Stock Exchange. Sounds boring? Yes. But that’s where you’ll see real business figures, not charts from TikTok. How to start trading on the stock market consciously? By understanding that when you buy a share, you become a co-owner of the company, not just betting on “red” or “black.”

Your task in the first stage is to save $500-$1000 that you are willing to freeze for your education. Never borrow money for trading. Never. This is an axiom1Axiom in finance — a statement that requires no proof due to the obvious tragic consequences.. I’ve seen too many broken lives because of credit money used on the exchange.

How Can an Ordinary Person Start Trading on the Exchange While Working a Full-Time Job?

The most frequent sub-query: “how can an ordinary person start trading on the exchange” without taking time off work. The answer is medium- and long-term trading. Intraday trading is a full-time job. I have a friend, a successful scalper. He wakes up at 6 AM, and by 10:00 AM he’s already drained. Do you need that? Probably not.

An ordinary person (doctor, teacher, engineer) can trade on the exchange in the evening. You choose 2-3 assets, analyze the chart on an hourly timeframe, and place limit orders. This is a strategy called “swing trading.” I used it when I was juggling work at a bank and personal trading. Pros: you don’t need to watch the screen every 5 minutes. Cons: a position can go negative for several days; you need nerves of steel.

I strongly advise beginners to avoid margin trading2Margin trading — making transactions with money borrowed from a broker against the security of your assets. at the start. 10:1 leverage is a path to bankruptcy. The broker won’t call you with a warning: “Careful, there’s about to be a stop-out.” They simply lock in the loss. So, to the question “how to start trading” I always answer: only with your own money and without leverage for the first six months.

How to Start Trading on the Exchange: A Step-by-Step Guide

Step 1. Choosing a Broker and Opening an Account

How to start trading on the stock exchange? Only through a licensed broker (like FINRA-member brokers in the US). I recommend beginners choose from the top 5 by trading volume: Fidelity, Charles Schwab, E*TRADE, Interactive Brokers, TD Ameritrade. Don’t chase ultra-low commissions from obscure brokers — they often skimp on IT infrastructure. My personal choice for a start is Fidelity or Charles Schwab for their educational resources. The process takes about 15 minutes: fill out the online application (providing SSN/tax ID), fund the account via bank transfer.

Important: when opening an account, you sign a brokerage agreement. Be sure to save the PDF of the agreement. It specifies the conditions under which the broker can forcibly close your positions (margin call). 90% of beginners don’t read this document and are later surprised by the fine print.

Step 2. Stock Market Trading Simulator for Beginners

Before depositing real money, be honest with yourself: do you understand how the order book (Level 2 data) works? Most beginners confuse the “last traded price” with the “price I can sell at right now.” The difference can be 0.5–1% in liquid stocks and up to 5% in illiquid ones. This is exactly where beginners lose their first money.

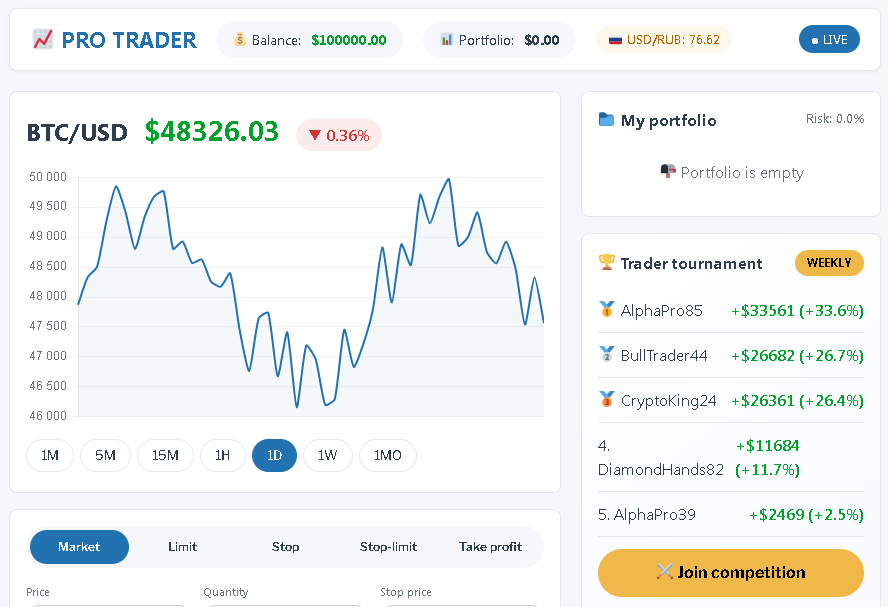

I make my students trade on a demo account for at least 2 weeks. The stock market trading simulator for beginners at brokers like TD Ameritrade (thinkorswim paper trading) or Interactive Brokers gives you $1,000,000 in virtual cash. The task: execute 50 trades without breaking the 2% risk-per-trade rule. Only after meeting this benchmark can you move on to real money.

Step 3. First Deposit and Entry Strategy

Fund your account with the minimum amount you are psychologically comfortable with. For some, that’s $500; for others, it’s $5,000. Don’t borrow money. Buy not one asset, but two or three from different sectors. For example: shares of Apple (tech), Exxon (energy), and Johnson & Johnson (healthcare). This is basic diversification. Don’t try to “time the bottom” perfectly. It’s better to enter now and gain experience than to wait a year and never start.

Personal experience: in 2015, I tried to convince a friend to buy Apple shares at $110 (split-adjusted). He waited for a correction to $100. By 2021, the shares were worth over $140. He never entered. How to start trading on the exchange from scratch? Place your first order. Today.

Step 4. Setting Up Risk Management

This is the most boring but the most important step. Before entering a trade, you must set a stop-loss. Not “I’ll set it later,” but immediately. On most platforms, this is a “stop order” or “stop-limit order.” You specify the price at which the asset will be sold automatically. Psychologically, this is difficult: it feels like the market is about to turn around. But the statistics are relentless: 80% of losing traders don’t use stop-losses systematically.

I set a hard rule for myself: stop-loss no further than 5% from the entry price for stocks and 10% for cryptocurrencies. If a stock drops 5%, it means I was wrong in my analysis. I exit, figure out why, and re-enter later.

Step 5. Trade Analysis and Trader’s Journal

You’ve made your first trade. You’ve locked in a profit or loss. What now? 99% of beginners close the app and go watch memes. Professionals log the trade in a journal. I’ve been keeping a spreadsheet in Google Sheets for 10 years. Fields: date, ticker, volume, entry price, exit price, reason for entry, emotions. After a month, you’ll see patterns in your behavior. For example: “I buy every time I see a green candle on the 15-minute chart, and I sell in a panic.” Awareness is the first step to correction.

Without this step, you’ll spin your wheels, making the same mistakes for years. How to start trading professionally? Stop being an “intuitive” and become an analyst of your own actions.

How to Start Trading on the NYSE/NASDAQ: Choosing a Broker and Plan

If you’re in the US and operating in dollars, your path lies through exchanges like the NYSE or NASDAQ. The question “how to start trading on the US stock exchange” is solved in about 15 minutes through a brokerage app. Previously, you had to go to an office and sign piles of papers. Now, digital technology has simplified entry but complicated the choice. You have three main paths: a bank-affiliated broker (like Chase You Invest), a classic broker (Fidelity, Schwab), or a robo-advisor (Betterment).

I am a client of three brokers to maintain an objective opinion. For beginners, I advise starting with Charles Schwab or Fidelity due to their simple interfaces and vast amount of educational content within the app. However, a potential minus is that their advanced trading platforms (like StreetSmart Edge or thinkorswim) might have a learning curve for complex options strategies. If you want to trade international stocks or specific ETFs, a broker like Interactive Brokers might be a better fit.

How to start trading with a bank-affiliated broker like Chase? They have a decent app, “You Invest.” My experience shows that they offer good integration with your bank account. The downside can be wider market-maker spreads3Spread — the difference between the ask price (price to buy) and the bid price (price to sell). The wider it is, the harder it is to profit from short-term moves. on less-liquid stocks. So for long-term purchases of blue chips (Apple, Microsoft, JPMorgan), any broker will do. For scalping, you might need a dedicated platform.

A separate story is starting with Interactive Brokers (IBKR). They are a veteran player. I opened my first account with them years ago for international access. Pros: powerful analytics, huge selection of instruments, the professional TWS (Trader Workstation) platform. Cons: the interface is not beginner-friendly. TWS can look intimidating, like software from another era. But if you master TWS, you’ll understand the logic of the exchange better than in a mobile app where commissions are hidden behind pretty charts.

Step-by-Step Algorithm: How to Start Trading with Fidelity and Charles Schwab

Let’s break down how to start trading with Fidelity literally step by step. Download the Fidelity Investments app or go to their website. Open a brokerage account or an IRA. This takes about 10-15 minutes; you’ll need your ID and SSN. After opening, you can’t trade immediately — you need to fund the account. It’s a small detail, but many stumble: “I opened it, but the buy button isn’t active.” Money needs to settle in the trading account, which can take a few days via bank transfer (though some offer instant funding).

The scheme for starting with Charles Schwab is identical. In the app or on the website, you go through the application process. An important tip: if you plan to trade actively, look into their premium platforms like thinkorswim (which Schwab acquired) or StreetSmart Edge. Standard accounts often have commission-free trades, which is great for beginners.

I often hear the question: “Can I open an account with one broker but trade through another’s platform?” Generally, no. Each broker has its own software. Exceptions exist, but for a beginner, it’s best to choose a broker based on the functionality of their platform.

International Level: How a Beginner Can Start Trading on a Crypto Exchange

Now, let’s move to the most volatile but alluring market. The query “how can a beginner start trading on a crypto exchange” is breaking popularity records. Crypto is the Wild West, lacking the regulation of stock exchanges like the NYSE. Here, you bear full responsibility for the security of your keys. I’ve been in crypto since 2017, surviving several halvings4Halving — the event where the reward for mining new blocks is halved, potentially leading to a supply shock and price increase. and market crashes.

The first rule of crypto: don’t keep everything on the exchange. The FTX story, where clients lost billions, proved: “Not your keys, not your coins.” So, when answering the question “how to start trading on Exmo or Bybit”, I always say: use the exchange only as an order book for trading; after the trade, withdraw large sums to a cold wallet5Cold wallet — a device (like Ledger) not connected to the internet, used for storing private keys..

How to start trading on the Mexc exchange? It’s a popular exchange among beginners due to low fees and a huge number of altcoins. The downside can be the interface quality and the requirement to upload a passport for verification, which deters many due to fear of data leaks. Similarly, starting to trade on Exmo. It’s one of the oldest exchanges, often friendly to certain regions. They have an English interface, and fiat on/off ramps were well-established. Now, in 2026, access can vary by jurisdiction, but it’s technically possible via P2P for many.

A market leader is how to start trading on Bybit? I consider Bybit one of the best for beginners for several reasons: an intuitive interface, a demo account, and a huge base of articles and videos. Plus, Bybit is a leader in liquidity. Slippage6Slippage — when an order is executed at a worse price than requested due to high volatility. on large volumes is very rare there. Tip: complete verification (KYC) right away, even if you don’t plan to deposit large sums. Limits for unverified users are tiny.

Important: never invest money in crypto that you need for a mortgage or medical treatment. This is a market that can drop 50% in a month and grow 10x in a year. It’s psychologically difficult to hold a 70% drawdown on Ethereum, even knowing it’s a cycle.

Real Case: How I Learned to Trade on Bybit

In 2020, I decided to master futures trading on Bybit. Before that, I only traded spot (buying the coin). My deposit was 1000 USDT. I opened a long position on ETH with 5x leverage. The price moved against me by 3%. In dollar terms, it’s small, but due to leverage, the loss was already 15%. I closed the trade at a loss. An hour later, the price reversed and shot up. I lost the profit due to fear. The moral: trading futures with leverage requires composure. Now I use leverage no higher than 2-3x and always set a stop-loss.

So, when answering the question “how to start trading on Bybit”, I emphasize: start with the spot market. Buy Bitcoin, wait a month, sell. Futures and perpetual contracts are an advanced level. Without experience, you’ll just burn through your money on fees and emotions.

Expert Advice: Regardless of whether you choose the NYSE or a crypto exchange, first get trained on a stock market trading simulator for beginners. On US stock exchanges, you can open a paper trading account on platforms like thinkorswim. On Bybit, there’s a “Testnet” feature — trading with virtual USDT. I require all my students to trade on a simulator for at least 20 hours. Only then will you understand the mechanics of stop orders and avoid paying for mistakes with real money.

The Dangerous Niche: How to Start Trading Binary Options

I must touch on this topic because thousands of people type the query “how to start trading binary options” into search engines. My answer will be harsh: don’t start. Binary options are not an exchange. They are bets on the direction of the price over a fixed time (60 seconds, 5 minutes). Platforms (like some you see advertised) do not execute your trades on the real market. You are playing against a “bucket shop”7Bucket shop — a fraudulent broker that does not hedge client positions but keeps the money. It’s in their interest for the client to lose..

The SEC directly calls binary options schemes fraudulent. Why? Because the mathematical expectation is negative. Even if you guess right on 60% of your trades, you’ll be in the red, as the payout rarely exceeds 85% with 100% risk. I once advised a woman who took out a loan for $3,000 to “win back” her losses on binary options. She lost everything in 2 days. I don’t want that to be you.

What to do instead? Trading futures on US exchanges or futures on Bybit is a legitimate way to profit from price movements, but there’s no minute-by-minute expiration. You have time to think. So, to the question “how to start trading on the exchange from scratch” with the goal of quick riches — the answer is: there will be no quick riches. There will be systematic work.

«Binary options are gambling disguised as investments. You don’t become a trader; you become a gambler. The odds are always with the house.»

How to Start Trading Forex, If You’re Being Lured Into It?

The query “how to start trading Forex” is closely related to the previous point. While there are legitimate Forex brokers in the US (regulated by the CFTC), much of what is advertised online are, again, bucket shops. The real interbank Forex market is not designed for retail clients with a $100 deposit. You simply don’t have access. You aren’t trading on the market; you’re trading with a dealing desk.

I started my journey back in 2011 with Forex. I had an account with a well-known broker. I lost $500 in a month. Then I switched to trading stocks on US exchanges and understood the difference. On Forex with a dealing desk, you see the quotes the broker shows you. On the exchange, you see the real order book (Level 2). It’s like playing poker with real people versus playing against a robot that can see your cards.

If you still want to trade currencies, you can do so via the futures market (like Euro FX futures on the CME) or currency ETFs traded on stock exchanges. The leverage is different, and it’s more transparent. How to start trading Forex safely? Only through exchange-traded instruments like futures or ETFs.

Stock Market Trading Simulator for Beginners: Learning Without Risk

Let’s return to the positive. The best thing humanity has invented for beginners is the stock market trading simulator for beginners. It’s the ability to make trades with virtual money in real-time. I strongly recommend using a simulator not to test the “profitability of a strategy,” but to test your own emotions.

For example, in the stock market trading simulator for beginners at TD Ameritrade (thinkorswim paper trading), you get $1,000,000 in virtual cash. You buy stocks, and they drop 5%. What’s your reaction? If you feel physically ill, even though the money isn’t real — you’re an emotional trader. If you calmly buy more on the dip, you have the makings of an investor. I run this test with all my students. Out of 10 people, only 2 maintain their composure.

The Bybit Testnet demo account allows you to trade derivatives without risk. Be sure to try opening a short8Short (Short) — a trade betting on a price decrease. The trader borrows an asset, sells it, and then buys it back cheaper. on a simulator. The concept of “selling what you don’t have” can be confusing for beginners. It’s better to be confused in a virtual environment than to lose a real $1,000 in 5 minutes.

TOP 3 Simulators I Recommend

- thinkorswim (Paper Trading) by TD Ameritrade/Schwab — the gold standard for paper trading. Incredibly powerful, simulates real market conditions perfectly.

- Interactive Brokers (Paper Account) — you can request a paper trading account. The interface is complex (TWS), but it’s what many professionals use, so learning it is valuable.

- Bybit Testnet — the best simulator for crypto. It has all order types, TradingView charts, and futures trading.

How to Start Trading on the Exchange and Not Lose Your Mind: Psychology and Risk Management

This is the pinnacle of the mastery pyramid. You can teach a monkey technical analysis. But risk management takes years of practice. Answering the main question “how to start trading on the exchange”, I instill one axiom in my students: risk no more than 2% of your capital on a single trade. Let’s say you have $5,000. You can only afford to lose $100 in one position. This allows you to survive 20 losing trades in a row (and it happens) and stay in the game.

I had a case in my practice. It was 2018, the market was range-bound, volatility was low. I broke my rule and put 5% of my capital into a volatile stock. News of weak sales came out, and the stock dropped 7% in a day. I lost a month’s profit in one hour. After that, I made a promise: 2%, not a dollar more. Since then, my equity curve has been smooth. How to start trading on trading platforms professionally? Make capital preservation a higher priority than profit.

Here’s a short checklist I give out during consultations. It will save your deposit:

- Never risk more than 2% on a single trade.

- Always set a stop-loss before entering a trade.

- Don’t average down on a losing position (don’t buy more as it falls until you understand why).

- Aim for a minimum profit-to-risk ratio of 1:2. Risk $10, plan to make $20.

- After a losing session, stop for the day. Don’t try to revenge trade.

| Criteria | How to Start on US Stock Exchange | How to Start on Crypto Exchange | Forex/Binary Options |

|---|---|---|---|

| Regulation | SEC, FINRA. Assets are protected (SIPC) | Minimal/Varies. Risk of exchange bankruptcy | Often minimal/unregulated. Dealing with offshore entities |

| Entry Barrier | From $1 (fractional shares) with many brokers | From $10 | From $10 |

| Transparency | High. Order book (Level 2) is visible | Medium. Can check reserves (Merkle tree) on some | Low/Zero. You see what the broker wants you to see |

I see my mission as helping you avoid repeating my mistakes. You can start trading on the exchange correctly only through systematic learning. Trading is the only profession where a person without an education tries to compete with professionals who have 15 years of analytical experience. But you have an advantage: you don’t need to beat the quant funds. You just need to be a little better than the crowd. And the crowd buys at highs and sells at lows. Do the opposite, and you will be profitable.

This guide is your foundation. Don’t look for easy money. Don’t listen to gurus selling courses for $5,000, promising a Lamborghini in a month. Trading is boring. It’s reports, discipline, and sleeping with your stop-loss set. But if you understand the philosophy of capital management, the exchange will cease to be a casino. It will become your personal money-printing machine, working on autopilot. Start today: choose a simulator, open a demo account, make your first virtual purchase of Apple or Bitcoin. In a year, you’ll thank me.

Frequently Asked Questions from Beginner Traders

How much money do I need to start trading on the exchange?

On US stock exchanges, with the advent of fractional shares, the entry barrier has dropped to $1 with many brokers. However, I recommend starting with an amount between $500 and $1,000. Smaller capital is hard to diversify, and while many brokers offer commission-free trades, the psychological impact of small gains/losses can be tricky. On crypto exchanges, the minimum entry is often $10-20 USDT, but effective trading usually starts from $200-300 USDT.

Can I trade on the exchange from my phone?

Yes, all modern brokers offer mobile apps. For long-term investing and swing trading, this is sufficient. For active intraday trading (scalping), a stationary terminal with a large screen and fast execution is generally necessary.

What tax do I pay on trading profits?

On US stock exchanges, the broker sends you a 1099 form summarizing your gains and losses. You are responsible for reporting this on your tax return (capital gains tax). On crypto exchanges, you are also required to declare your income. Many traders who don’t convert crypto to fiat mistakenly believe they don’t need to pay taxes — this is a myth. Tax obligations arise upon realizing a gain, regardless of the form.

Which is harder: the stock market or cryptocurrency?

Emotionally, cryptocurrency is harder due to 24/7 trading and high volatility. Fundamentally, the stock market can be more complex — you need to analyze company reports, macroeconomic indicators, and industry trends. Crypto is currently more tied to sentiment and liquidity flows. I advise starting with the stock market to train discipline, and then gradually moving into crypto.

📝

- 1Axiom in finance — a statement that requires no proof due to the obvious tragic consequences.

- 2Margin trading — making transactions with money borrowed from a broker against the security of your assets.

- 3Spread — the difference between the ask price (price to buy) and the bid price (price to sell). The wider it is, the harder it is to profit from short-term moves.

- 4Halving — the event where the reward for mining new blocks is halved, potentially leading to a supply shock and price increase.

- 5Cold wallet — a device (like Ledger) not connected to the internet, used for storing private keys.

- 6Slippage — when an order is executed at a worse price than requested due to high volatility.

- 7Bucket shop — a fraudulent broker that does not hedge client positions but keeps the money. It’s in their interest for the client to lose.

- 8Short (Short) — a trade betting on a price decrease. The trader borrows an asset, sells it, and then buys it back cheaper.